Optex Systems Holdings, Inc. Announces Period Ended June 27, 2021 Financial Highlights

RICHARDSON, TX / ACCESSWIRE / August 16, 2021 / Optex Systems Holdings, Inc. (OTCQB:OPXS), a leading manufacturer of precision optical sighting systems for domestic and worldwide military and commercial applications, announced financial highlights for its three and nine-month period ended June 27, 2021.

During the three and nine months ended June 27, 2021, revenue decreased from our prior year period by $1.4 million and $5.5 million, or 24.2% and 29.6%, and gross margin decreased from our prior year period by $0.7 million and $2.6 million, or 49.67% and 57.1%, respectively, Operating income for the three and nine-month period ended June 27, 2021 decreased by $0.6 million and $2.4 million, to income of $0.4 million and a loss of ($0.3) million, from income of $0.6 million and $2.1 million during the prior year period, respectively.

The decrease in gross margin and operating profit during the three and nine-month periods are primarily attributable lower revenue and unfavorable manufacturing overhead on reduced production volume. Our operating segments have substantial fixed manufacturing costs that are not easily adjusted as production levels decline. While we have implemented several cost-saving initiatives during the first three quarters, including reductions in force and employee compensation combined with decreases in other discretionary spending we anticipate a net operating loss for the fiscal year ending October 3, 2021.

As of June 27, 2021, the Company had working capital of $12.3 million, as compared to $11.7 million as of September 27, 2020. During the nine months, we generated operating cash flow of $1.1 million, and spent $0.8 million for the purchase of 413,533 shares against our previously announced stock repurchase plan. We ended the quarter with a strong cash balance of $4.8 million as compared to $4.7 million as of the fiscal year end 2020. As of June 27, 2021, the Company had an outstanding payable balance of $0.4 million against our working line of credit. The line of credit allows for borrowing up to a maximum of $2.25 million. As of June 27, 2021, our outstanding accounts receivable was $1.4 million.

Danny Schoening, CEO of Optex Systems Holdings, Inc., commented, "We continue to be cautiously optimistic about returning to the 2020 run rates. The large Laser Filter bookings from the AOC Division are timely and emphasize the unique relationship with our customers and the core competencies that we provide to enable them to complete their mission."

Our key performance measures for the three and nine-months ended June 27, 2021 and June 28, 2020 are summarized below.

| (Thousands) | |||||||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||||||

Metric |

June 27, 2021 | June 28, 2020 | % Change | June 27, 2021 | June 28, 2020 | % Change | |||||||||||||

Revenue |

$ | 4,433 | $ | 5,849 | (24.2 | ) | $ | 13,149 | $ | 18,682 | (29.6 | ) | |||||||

Gross Margin |

$ | 746 | $ | 1,481 | (49.6 | ) | $ | 1,959 | $ | 4,568 | (57.1 | ) | |||||||

Gross Margin % |

16.8 | % | 25.3 | % | (33.6 | ) | 14.9 | % | 24.5 | % | (39.2 | ) | |||||||

Operating Income |

$ | 57 | $ | 626 | (90.9 | ) | $ | (279 | ) | $ | 2,126 | (113.1 | ) | ||||||

Gain (Loss) on Change Fair Value of Warrants |

$ | 1,167 | $ | (585 | ) | (299.5 | ) | $ | 2,025 | $ | (504 | ) | (501.8 | ) | |||||

Net Income (Loss) Applicable to Common Shareholders |

$ | 910 | $ | (95 | ) | (1,057.9 | ) | $ | 1,237 | $ | 798 | 55.0 | |||||||

Adjusted EBITDA (non-GAAP) |

$ | 181 | $ | 750 | (75.9 | ) | $ | 87 | $ | 2,431 | (96.4 | ) | |||||||

During the previous fifteen months, we have experienced a significant reduction in new orders and ending customer backlog across all but one of our product lines. We attribute the lower orders to a combination of factors including a COVID-19 driven slow-down of contract awards for both U.S. military sales and foreign military sales (FMS), combined with some shifting in defense spending budget allocations in US military sales and FMS away from Army ground system vehicles toward other military agency applications. While we are optimistic that our customer orders will return to pre-pandemic levels over the next twelve months, we currently anticipate a 30-32% reduction in our total fiscal year performance in 2021 as compared to the fiscal year performance of 2020. We are reviewing additional cost reductions during the next sixty to ninety days as required to further minimize the impact of any sustained delays in customer orders at the Optex Richardson segment beyond the first three quarters of fiscal year 2021.

Backlog as of June 27, 2021, was $12.9 million as compared to a backlog of $16.3 million as of September 27, 2020, representing a decrease of $3.4 million or 20.9%. During the nine months ended June 27, 2021 the Company booked $9.8 million in new orders as compared to $14.0 million during the nine months ended June 28, 2020.

We have experienced a recent increase in proposal requests, and anticipate an increase in orders over the next three to six months. Subsequent to the period ended June 27, 2021, the Company has booked an additional $11.7 million in customer orders, including a new contract award of $8.4 million announced on August 3, 2021, as part of a twenty-four-month purchase order for laser filters manufactured at the Applied Optics Center segment.

|

|

(millions) |

|

||||||||

| June 27, 2021 | September 27, 2020 | % Change | ||||||||

Backlog as of period end |

$ | 12.9 | $ | 16.3 | (3.4 | ) | ||||

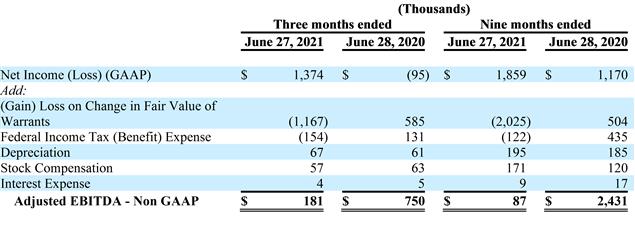

We use adjusted earnings before interest, taxes, gains/losses on changes in fair values, depreciation and amortization (EBITDA) as an additional measure for evaluating the performance of our business as "net income" includes the significant impact of non-cash valuation gains and losses on warrant liabilities, noncash compensation expenses related to equity stock issuances, as well as depreciation, amortization, interest expenses and federal income taxes. We believe that adjusted EBITDA is a meaningful indicator of our operating performance because it permits period-over-period comparisons of our ongoing core operations before certain excluded items. Adjusted EBITDA is a financial measure not required by, or presented in accordance with, U.S. generally accepted accounting principles ("GAAP").

The table below summarizes our three-month operating results for periods ended June 27, 2021 and June 28, 2020, in terms of both the GAAP net income measure and the non-GAAP adjusted EBITDA measure. We believe that including both measures provides information that is useful in evaluating our financial results across periods.

Our adjusted EBITDA decreased to $0.2 million during the three months ended June 27, 2021 as compared to $0.7 million during the three months ended June 28, 2020. Adjusted EBITDA for the nine-month period ended June 27, 2021 decreased to $0.1 million from $2.4 million in the prior year nine-month period. The decrease in the three and nine-month periods is primarily driven by lower revenue and gross margin across both operating segments.

Highlights of the unaudited Condensed Consolidated and Segment Results of Operations have been prepared in accordance with GAAP. These financial highlights do not include all information and disclosures required in the consolidated financial statements and footnotes, and should be read in conjunction with our Quarterly Report on Form 10-Q for the period ended June 27, 2021 filed with the SEC on August 16, 2021, and our Annual Report on Form 10-K for the year ended September 27, 2020 filed with the SEC on December 17, 2020.

Optex Systems Holdings, Inc.

Condensed Consolidated Statements of Operations

| (Thousands, except share and per share data) | |||||||||||

| Three months ended | Nine months ended | ||||||||||

| June 27, 2021 | June 28, 2020 | June 27, 2021 | June 28, 2020 | ||||||||

Revenue |

$ | 4,433 | $ | 5,849 | $ | 13,149 | $ | 18,682 | |||

Cost of Sales |

3,687 | 4,368 | 11,190 | 14,114 | |||||||

Gross Margin |

746 | 1,481 | 1,959 | 4,568 | |||||||

General and Administrative Expense |

689 | 855 | 2,238 | 2,442 | |||||||

Operating Income (Loss) |

57 | 626 | (279) | 2,126 | |||||||

Gain (Loss) on Change in Fair Value of Warrants |

1,167 | (585) | 2,025 | (504) | |||||||

Interest Expense |

(4) | (5) | (9) | (17) | |||||||

Other Income (Expense) |

1,163 | (590) | 2,016 | (521) | |||||||

Income Before Taxes |

1,220 | 36 | 1,737 | 1,605 | |||||||

Income Tax Expense (Benefit), net |

$ | (154) | $ | 131 | (122) | 435 | |||||

Net Income (Loss) |

$ | 1,374 | $ | (95) | $ | 1,859 | $ | 1,170 | |||

Deemed dividends on participating securities |

(464) | - | (622) | (372) | |||||||

Net income (loss) applicable to common shareholders |

$ | 910 | $ | (95) | $ | 1,237 | $ | 798 | |||

Basic income (loss) per share |

$ | 0.11 | $ | (0.01) | $ | 0.15 | $ | 0.09 | |||

Weighted Average Common Shares Outstanding - basic |

8,101,223 | 8,491,803 | 8,204,994 | 8,472,739 | |||||||

Diluted income (loss) per share |

$ | 0.11 | $ | (0.01) | $ | 0.15 | $ | 0.09 | |||

Weighted Average Common Shares Outstanding - diluted |

8,138,106 | 8,491,803 | 8,292,544 | 8,596,745 | |||||||

The accompanying notes in our Quarterly Report on Form 10-Q for the period ended June 27, 2021 filed with the SEC on August 16, 2021 are an integral part of these financial statements.

Optex Systems Holdings, Inc.

Condensed Consolidated Balance Sheets

| (Thousands, except share and per share data) | |||||

| June 27, 2021 | September 27, 2020 | ||||

| (Unaudited) |

|

||||

ASSETS |

|||||

Cash and Cash Equivalents |

$ | 4,758 | $ | 4,700 | |

Accounts Receivable, Net |

1,382 | 2,953 | |||

Inventory, Net |

8,645 | 8,791 | |||

Prepaid Expenses |

324 | 229 | |||

Current Assets |

15,109 | 16,673 | |||

Property and Equipment, Net |

1,026 | 1,006 | |||

Other Assets |

|||||

Deferred Tax Asset |

1,309 | 1,227 | |||

Right-of-use Asset |

3,721 | 1,416 | |||

Security Deposits |

23 | 23 | |||

Other Assets |

5,053 | 2,666 | |||

Total Assets |

$ | 21,188 | $ | 20,345 | |

LIABILITIES AND STOCKHOLDERS' EQUITY |

|||||

Current Liabilities |

|||||

Accounts Payable |

$ | 408 | $ | 833 | |

Credit Facility |

377 | - | |||

Operating Lease Liability |

529 | 417 | |||

Accrued Expenses |

872 | 1,077 | |||

Warrant Liability |

519 | 2,544 | |||

Accrued Warranty Costs |

68 | 83 | |||

Customer Advance Deposits |

- | 1 | |||

Current Liabilities |

2,773 | 4,955 | |||

Other Liabilities |

|||||

Credit Facility |

- | 377 | |||

Operating Lease Liability, net of current portion |

3,254 | 1,037 | |||

Other Liabilities |

3,254 | 1,414 | |||

Total Liabilities |

6,027 | 6,369 | |||

Commitments and Contingencies |

- | ||||

Stockholders' Equity |

|||||

Common Stock - ($0.001 par, 2,000,000,000 authorized, 8,334,995 and 8,795,869 shares issued, and 8,334,995 and 8,690,136 outstanding, respectively) |

8 | 9 | |||

Treasury Stock (at cost, zero and 105,733 shares held, respectively) |

- | (200) | |||

Additional Paid in capital |

25,403 | 26,276 | |||

Accumulated Deficit |

(10,250) | (12,109) | |||

Stockholders' Equity |

15,161 | 13,976 | |||

Total Liabilities and Stockholders' Equity |

$ | 21,188 | $ | 20,345 | |

The accompanying notes in our Quarterly Report on Form 10-Q for the period ended June 27, 2021 filed with the SEC on August 16, 2021 are an integral part of these financial statements.

ABOUT OPTEX SYSTEMS

Optex, which was founded in 1987, is a Richardson, Texas based ISO 9001:2015 certified concern, which manufactures optical sighting systems and assemblies, primarily for Department of Defense (DOD) applications. Its products are installed on various types of U.S. military land vehicles, such as the Abrams and Bradley fighting vehicles, Light Armored and Armored Security Vehicles, and have been selected for installation on the Stryker family of vehicles. Optex also manufactures and delivers numerous periscope configurations, rifle and surveillance sights, and night vision optical assemblies. Optex delivers its products both directly to the military services and to prime contractors. For additional information, please visit the Company's website at www.optexsys.com.

Safe Harbor Statement

This press release contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the products and services described herein. You can identify these statements by the use of the words "may," "will," "could," "should," "would," "plans," "expects," "anticipates," "continue," "estimate," "project," "intend," "likely," "forecast," "probable," and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs and military spending, the timing of such funding, general economic and business conditions, including unforeseen weakness in the Company's markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in the U.S. Government's interpretation of federal procurement rules and regulations, changes in spending due to policy changes in any new federal presidential administration, market acceptance of the Company's products, shortages in components, production delays due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, changes in the market for microcap stocks regardless of growth and value and various other factors beyond our control.

You must carefully consider any such statement and should understand that many factors could cause actual results to differ from the Company's forward-looking statements. These factors include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. The Company does not assume the obligation to update any forward-looking statement. You should carefully evaluate such statements in light of factors described in the Company's filings with the SEC, especially on Forms 10-K, 10-Q and 8-K. In various filings the Company has identified important factors that could cause actual results to differ from expected or historic results. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete list of all potential risks or uncertainties.

CONTACT:

IR@optexsys.com

1-972-764-5718

SOURCE: Optex Systems Holdings, Inc.

View source version on accesswire.com:

https://www.accesswire.com/659726/Optex-Systems-Holdings-Inc-Announces-Period-Ended-June-27-2021-Financial-Highlights

Released August 16, 2021