UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2022 Proxy Statement

Notice of Annual Meeting

of Shareowners

Tuesday, April 26, 2022

8:30 a.m. Eastern Time

| THE COCA-COLA COMPANY 2022 PROXY STATEMENT | |

| QUESTIONS AND ANSWERS |

| Please see Questions and Answers in Annex A beginning on page 99 for important information about the 2022 Annual Meeting of Shareowners, proxy materials, voting, Company documents, communications, and the deadlines to submit shareowner proposals and Director nominees for the 2023 Annual Meeting of Shareowners. Additional questions may be directed to Shareowner Services at (404) 676-2777 or shareownerservices@coca-cola.com. |

Links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (the “SEC”).

This Proxy Statement contains information that may constitute “forward-looking statements.” Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future, including statements expressing general views about future operating results, are forward-looking statements. Management believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause our Company’s actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021 (“Form 10-K”) and those described from time to time in our future reports filed with the SEC.

| 1 | Notice of 2022 Annual Meeting of Shareowners |

Meeting Information |

Voting Methods Please vote using one of the following advance voting methods. Make sure to have your proxy card or voting instruction form in hand and follow the instructions. Shareowners may also vote during the meeting by accessing the virtual meeting according to the instructions in question 2 on page 99. ADVANCE VOTING: SHAREOWNERS OF RECORD

Internet

www.investorvote.com/coca-cola

Telephone Call 1-800-652-VOTE or the telephone number on your proxy card

Mail Sign, date and return your proxy card ADVANCE VOTING: BENEFICIAL OWNERS

Internet

www.proxyvote.com

Telephone Call 1-800-454-8683 or the telephone number on your voting instruction form

Mail Sign, date and return your voting instruction form Not all beneficial owners may vote at the web address and phone number provided above. If your control number is not recognized, please refer to your voting instruction form for specific voting instructions. |

||||||||||||

|

DATE AND TIME Tuesday, April 26, 2022 8:30 a.m. Eastern Time |

|

RECORD DATE Holders of record of our Common Stock as of February 25, 2022 are entitled to notice of, and to vote at, the meeting. |

||||||||||

|

VIRTUAL MEETING LOCATION The 2022 Annual Meeting of Shareowners will be held exclusively online. Visit https://meetnow. global/KO2022 to attend the meeting. |

|

ANNUAL MEETING WEBSITE Access links to vote in advance, listen to video messages from certain of our Directors, submit questions in advance of the meeting and learn more about our Company at www.coca-colacompany.com/annual-meeting-of-shareowners. |

||||||||||

| Items of Business | Our Board’s Recommendation |

Page | |||||||||||

| COMPANY PROPOSALS | |||||||||||||

| 1 | Elect as Directors the 11 Director nominees named in the attached Proxy Statement to serve until the 2023 Annual Meeting of Shareowners. |  |

FOR each Director Nominee |

12 | |||||||||

| 2 | Conduct an advisory vote to approve executive compensation. |  |

FOR | 46 | |||||||||

| 3 | Ratify the appointment of Ernst & Young LLP as Independent Auditors of the Company to serve for the 2022 fiscal year. |  |

FOR | 87 | |||||||||

| SHAREOWNER PROPOSALS | |||||||||||||

| 4 | Vote on a shareowner proposal regarding an external public health impact disclosure. |  |

AGAINST | 90 | |||||||||

| 5 | Vote on a shareowner proposal regarding a global transparency report. |  |

AGAINST | 94 | |||||||||

| 6 | Vote on a shareowner proposal regarding an independent Board Chair policy. |  |

AGAINST | 97 | |||||||||

Shareowners will also transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting. Your vote is important to us. Whether or not you plan to participate in the 2022 Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the attached Proxy Statement. The 2022 Annual Meeting will be held entirely online via live webcast. While you will not be able to attend the meeting at a physical location, we are committed to ensuring that shareowners will be afforded the same rights and opportunities to participate at the virtual meeting as they would at an in-person meeting. As a shareowner, you will be able to attend the meeting online, examine our list of shareowners, vote your shares electronically and submit questions during the meeting. We are continuing with a virtual format for our 2022 Annual Meeting by leveraging the latest technology to provide expanded access, which allows shareowners to participate from any location around the world, at no cost to them. To attend the 2022 Annual Meeting, visit https://meetnow.global/KO2022. For more information on how to participate in the 2022 Annual Meeting, please see Annex A of the attached Proxy Statement beginning on page 99. We are making the Proxy Statement and the form of proxy first available on or about March 11, 2022. March 11, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2022 ANNUAL MEETING OF SHAREOWNERS TO BE HELD ON APRIL 26, 2022: The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2021 are available at www.edocumentview.com/coca-cola. |

|||||||||||||

| 2 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 3 |

|

|

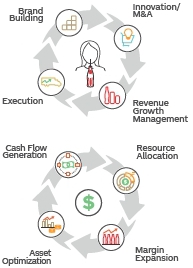

In 2021, we worked together to build a networked global organization, combining the power of scale with the deep knowledge and cross-functional collaboration required to win locally. We emphasized the importance of an agile, collaborative and networked environment. We embraced a culture of improvement, recognizing that the first answer may not be the final answer. We continued to foster a growth mindset, which helps enable our people to drive sustainable, long-term results. Business with purpose Our purpose guides us as a Company: to refresh the world and make a difference. Our growth strategies focus on how we refresh the world with our products. I’ll conclude by talking about how we make a difference. Our work in ESG – environmental, social and governance – is integrated into our strategies. We are committed to making a difference through our interconnected and evolving ESG goals. I’ll start with diversity, equity and inclusion. We’ve refreshed the Company’s global diversity, equity and inclusion strategy to reflect the need for greater global reach, broader impact and a focus on equity and economic empowerment. We aspire for our workforce to mirror the markets we serve. We celebrate uniqueness and strive to create an inclusive environment. In 2021, we set a 2030 aspiration to mirror U.S. census data for race and ethnicity at all job levels of our Company in the United States. We also recommitted to our aspiration to be 50% led by women, with a target of 2030. In 2021, we celebrated surpassing our women’s economic empowerment goal, reaching more than 6 million women through partnerships with NGOs, governments and communities – partnerships that help build local women-owned businesses and community resilience. Connected priorities The past 50 years have brought needed and increased awareness of global ecological and climate challenges. In particular, the previous five years have reminded us that collective |

action and investment by businesses, governments and civil society are required to address the global environmental agenda. We’ve been intentional about lowering our environmental impact for years. We can, and will, do more to contribute to restorative and regenerative practices, like focusing on water replenishment activities in places with the greatest needs. Combating the climate crisis requires a global effort, so we worked with experts to set science-based targets. We made solid progress to decarbonize our system through our “drink in your hand” goal, which we’ve achieved. We’ve increased our ambitions through our 2030 greenhouse gas emissions target to reduce absolute emissions by 25%. Our long-term ambition is to be net zero carbon by 2050. A World Without Waste, where materials are recycled and reused as part of a circular economy, is a world with dramatically lower carbon emissions and climate impacts, which is why our packaging and climate strategies are intertwined. Our World Without Waste program expanded in 2021 to include a virgin plastic reduction goal. We also announced new or expanded partnerships with innovators and NGOs like our PlantBottle partners, World Wildlife Fund and The Ocean Cleanup. Looking ahead In closing, I want to recognize the people of our Company and system. Together, we emerged stronger in 2021. Our networked way of working drove strong results. I am optimistic about our future and what we can accomplish together in 2022. Thank you for your support and investment in this next stage in our journey.

|

“As a Company, we focus on what we do best — building brands and growing markets for those brands, together with our bottling partners.” |

|

| 4 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

|

Our Company |

The Coca-Cola Company (the “Company”) is a total beverage company with products sold in more than 200 countries and territories. Our Company’s purpose is to refresh the world and make a difference. Our brands include:

|

SPARKLING Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Fresca, Schweppes*, Sprite and Thums Up |

|

HYDRATION, SPORTS, Aquarius, Ayataka, BODYARMOR, Ciel, Costa, doğadan, Dasani, FUZE TEA, Georgia, glacéau smartwater, glacéau vitaminwater, Gold Peak, Ice Dew, I LOHAS, Powerade and Topo Chico |

|

NUTRITION, JUICE, AdeS, Del Valle, fairlife, innocent, Minute Maid, Minute Maid Pulpy and Simply |

|

* |

Schweppes is owned by the Company in certain countries outside the United States. |

THE COCA-COLA SYSTEM

We are a networked global organization designed to combine the power of scale with the deep knowledge required to win locally. We are able to create global reach with local focus because of the strength of the Coca-Cola system, which comprises our Company and our approximately 225 bottling partners worldwide.

OUR GLOBAL REACH

Beverage products bearing our trademarks, sold in the United States since 1886, are now sold in more than 200 countries and territories.

| ● | We make our branded beverage products available to consumers throughout the world through our network of independent bottling partners, distributors, wholesalers and retailers as well as our consolidated bottling and distribution operations. |

| ● | Consumers enjoy finished beverage products bearing trademarks owned by or licensed to us at a rate of 2.1 billion servings a day. |

|

LEARN MORE ABOUT |

||

|

You can learn more about the Company by visiting our website, www.coca-colacompany.com. We also encourage you to read our latest Form 10-K, available at www.coca-colacompany.com/ annual-meeting-of-shareowners. The Company’s principal executive offices are located at One Coca-Cola Plaza, Atlanta, Georgia 30313. |

||

| Guided by Our Purpose | Rooted in Our Strategy | Key Objectives |

|

|

|

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 5 |

|

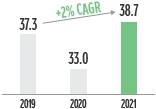

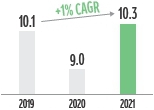

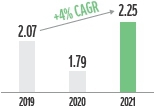

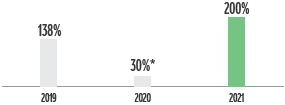

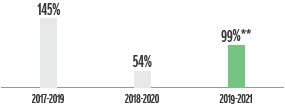

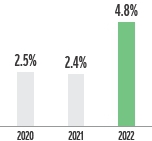

| 2021 Financial Highlights |

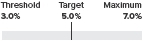

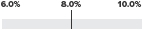

| REVENUE GROWTH | OPERATING INCOME GROWTH |

EARNINGS PER SHARE | CASH FLOW | TOTAL DIVIDENDS PAID | ||||

|

17% |

16% |

15% |

12% |

$2.25 |

$2.32 |

$12.6 |

$11.3 |

$7.3 |

|

Reported Net Operating Revenues vs. 2020 |

Organic Revenues vs. 2020 (Non-GAAP) |

Reported Operating Income vs. 2020 |

Comparable Currency Neutral Operating Income vs. 2020 (Non-GAAP) |

Reported EPS |

Comparable EPS (Non-GAAP) |

BILLION |

BILLION |

BILLION |

|

Organic revenues is a non-GAAP financial measure that excludes or has otherwise been adjusted for the impact of acquisitions, divestitures and structural changes, as applicable, and the impact of changes in foreign currency exchange rates. Comparable currency neutral operating income is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability and the impact of changes in foreign currency exchange rates. Comparable EPS is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability. Free cash flow is a non-GAAP financial measure that represents net cash provided by operating activities less purchases of property, plant and equipment. See Annex C on page 110 for reconciliations of non-GAAP financial measures to our results as reported under generally accepted accounting principles in the United States (“GAAP”). | ||||||||

| 2021 Business Highlights |

Throughout 2021, we faced an operating environment that remained dynamic, due to the ongoing COVID-19 pandemic. Our unparalleled system strength and strategic transformation enabled us to be agile and adaptable, and we emerged stronger – delivering strong results in key metrics that surpassed our 2019 pre-pandemic results. We remained focused on building a stronger total beverage company. Important highlights from the year include:

|

PORTFOLIO |

|

|

●Delivered 8% unit case volume growth for the year, resulting in volume ahead of pre-pandemic results in 2019, driven by strong performance across developed, developing and emerging markets.

●Acquired the remaining 85% ownership interest in BODYARMOR, a line of sports performance and hydration beverages that has significant potential for long-term growth.

●Grew gross profit per launch by approximately 25%, through our robust, consumer-centric innovation pipeline. |

●Scaled local “intelligent experiments” across geographies. Examples include sustainable packaging, such as refillables and label-less bottles, along with brands, including Coke® with Coffee, fairlife®, AHA®, CostaTM ready-to-drink, Lemon DouTM and Topo Chico® Hard Seltzer.

●Continued to streamline our portfolio, completing approximately 50% of brand transitions and eliminations toward our goal of having approximately 200 master brands. |

|

STRATEGY |

|

|

●As part of the Company’s agenda to transform and modernize marketing and innovation as key drivers of profitable growth, the Company launched a new, integrated agency model, naming WPP as the Company’s global marketing network partner.

●Completed the rewiring of our networked organization, to better connect functions and operating units to help our system scale ideas faster, with approximately 5,000 employees in new roles. |

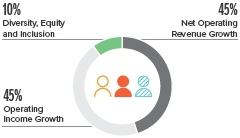

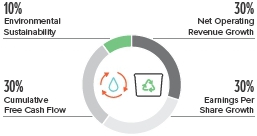

●Finalized plans to further link ESG goals to annual and long-term incentive compensation programs, with a focus on environmental sustainability and diversity, equity and inclusion.

●Announced a new, global goal to reach 25% reusable packaging by 2030 to complement and support the Company’s World Without Waste goals. |

|

EXECUTION |

|

|

●Grew basket incidence, a key metric of consumer purchase frequency for our beverages, by 3.5% versus 2019 levels (includes 30 of the top 40 markets; excludes dairy and plant-based beverages).

●Delivered low to mid single-digit growth in outlets, shelf space and cooler placement, leading to revenue growing faster than transactions, with both growing at a faster rate than volume.

●Drove strong customer value with the Coca-Cola system’s top 20 customers, growing system revenue by high single digits in 2021. |

●Gained value share in total nonalcoholic ready-to-drink (“NARTD”) beverages, which included share gains in both at-home and away-from-home channels. Value share in total NARTD beverages, as well as in both at-home and away-from-home channels, was ahead of 2019 levels.

●Continued to partner with bottlers to leverage the power of the system’s physical footprint online, creating enhanced value for customers across the globe through a best-in-class eB2B platform. |

| 6 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

| Human Capital |

Our people and culture agendas are critical business priorities, and we strive to be a global employer of choice that attracts and retains high-performing talent with the passion, skills and mindsets to drive us on our journey to refresh the world and make a difference. We are committed to building an equitable and inclusive culture that inspires and supports the growth of our employees, serves our communities and shapes a more sustainable business.

OUR HUMAN CAPITAL PILLARS

|

Leadership, Talent and Development |

|

Our strategy is anchored in promoting the right internal talent and hiring the right external talent for career opportunities across our networked organization to create an employee experience that is locally relevant and individually rewarding. We focus on hiring and developing talent that mirrors the markets we serve, along with investing in inspirational leadership, learning opportunities and capabilities that equip our global workforce with the skills they need while improving engagement and retention. We expect our leaders to be role models and lead in a way that enables our organization to achieve success and win in the future. | |

|

Diversity, Equity and Inclusion |

|

We believe that a diverse, equitable and inclusive workplace which mirrors the markets we serve is a strategic business priority that is critical to the Company’s success. We take a comprehensive view of diversity and inclusion across different races, ethnicities, tribes, religions, socioeconomic backgrounds, generations, abilities and expressions of gender and sexual identity. We are continuing to put our resources and energy into strategies and initiatives to create a more equitable environment. | |

|

Human Rights |

|

Respect for human rights is a fundamental value of our Company. We strive to respect and promote human rights in accordance with the United Nations Guiding Principles on Business and Human Rights in our relationships with our employees, suppliers and independent bottlers. Our aim is to make continuous and meaningful improvements in the way we do business around the world. | |

|

Culture and Engagement |

|

Each employee, leader and function across our Company contributes to our growth culture, which is grounded in our Company’s purpose. We focus on four key growth behaviors – being curious, empowered, inclusive and agile – and we value how we work as much as what we achieve. We believe our culture enables our Company’s business strategy and shapes employee experiences. | |

|

Business Integrity |

|

Our Codes of Business Conduct are grounded in our commitment to do the right thing. They serve as the foundation of our approach to ethics and compliance, and our anti-corruption compliance program is focused on conducting business in a fair, ethical and legal manner. | |

|

2021 NOTABLE |

||

|

Ranked in Top 25 on FORTUNE’s annual ranking of the World’s Most Admired Companies Included in the Bloomberg 2021 Gender-Equality Index as a company committed to supporting gender equality through policy development, representation and transparency Earned a 100% score on the Human Rights Campaign’s Corporate Equality Index for the 15th consecutive year Recognized by Disability Equality Index as one of the Best Places to Work for Disability Inclusion Listed in LATINA Style’s 2021 Top 50 Best Companies for Latinas to Work in the U.S. |

||

| Our people and culture agendas are key priorities of the Board of Directors (the “Board”). Through the Talent and Compensation Committee, the Board provides oversight of the Company’s policies and strategies relating to talent, leadership and culture, including diversity, equity and inclusion (“DEI”). See page 27 for information regarding the Board’s oversight of Human Capital. |  |

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 7 |

|

|

GLOBAL DIVERSITY, EQUITY AND INCLUSION STRATEGY |

We believe that a diverse, equitable and inclusive workplace that mirrors the markets we serve is a strategic business priority and critical to the Company’s success. We continue to advance our DEI initiatives inside our Company as well as in the communities we call home. We have developed our DEI plans with permanence in mind, while being open to evolve our plans as we continue to progress toward our aspirations.

In 2021, we refreshed the Company’s global DEI strategy to reflect the need for greater global reach, broader impact, a focus on equity, and the incorporation of social justice and economic empowerment initiatives into our global efforts.

Our DEI strategy comprises three long-term ambitions: (i) we aspire for our diverse workforce to mirror the markets we serve; (ii) we strive for equity for all people; and (iii) we celebrate uniqueness and create an inclusive environment. Our 2021 highlights in furtherance of these ambitions are presented below:

| 8 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

| Sustainability |

As a crucial part of our broader environmental, social and governance (“ESG”) goals, sustainability is embedded in how we operate as a business. Our sustainability strategies enable the Company to proactively respond to consumer preferences and address emerging challenges, building greater resilience in our business to withstand future changes. In everything we do, we aim to create a more sustainable business and better shared future that make a difference in people’s lives, the communities we serve and the planet. We recognize that the sustainability of our business is directly linked to the sustainability of the ecosystems in which we operate, and that is why our approach is guided by our purpose: to refresh the world and make a difference.

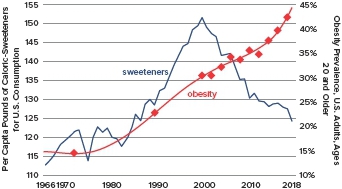

Our sustainability priorities cover the following areas: water stewardship; reducing added sugar; packaging circularity; climate action; sustainable agriculture; and people and communities. Through internal and external stakeholder engagement, we have identified the highest-priority issues for the Company, allowing us to grow our business while mitigating risk. Working collaboratively with our bottling partners and stakeholders at every stage of our value chain, we look to integrate ESG considerations into our daily actions.

|

Water Stewardship |

We strive to replenish water back to nature and communities, improve efficiency and treat wastewater to high standards. Our ability to grow our business as well as communities’ capacity to thrive depends on access to clean water resources. We know local water resources are impacted by changing weather patterns and climate change. That is why our 2030 water security strategy seeks to build greater resilience in the watersheds where scarcity impacts our business, supply chain and communities. | |

|

Sugar Reduction |

We are building a total beverage company, which includes offering more choices with less sugar, reducing packaging sizes and providing clear nutrition information. We are listening to consumers, and we understand that people around the world have an increased interest in managing the food and beverages they consume. Within our portfolio of brands, we are taking action to reduce added sugar by offering consumers more choices with less sugar, reducing packaging sizes to enable portion control, and promoting our low- and no-calorie beverages, all while providing clear nutrition information so our consumers can make informed choices. | |

|

World Without Waste |

Our vision is to make packaging part of a circular economy, thereby keeping it out of our environment. Our World Without Waste program focuses on creating a circular economy for our packaging materials, which account for approximately 30% of the Coca-Cola system’s overall carbon footprint. By using more recycled content, developing plant-based materials, light-weighting our packages and expanding our refillable business model while increasing collection of empty bottles, we are delivering against both our climate and waste reduction goals. | |

|

Climate |

We look for ways to reduce carbon emissions across the Coca-Cola value chain. We are reducing carbon emissions across our system by interconnecting our ESG goals across the Coca-Cola system and value chain. After achieving our 2020 “drink in your hand” goal to reduce relative carbon emissions by 25% against a 2010 baseline, we have taken it a step further and set a science-based target to reduce greenhouse gas emissions by 25% across the entire value chain by 2030 as compared to a 2015 baseline. We support a vision to be net zero carbon by 2050, and our science-based target is a critical milestone that supports this longer-term ambition. | |

|

Sustainable Agriculture |

Our goal is to source our priority ingredients sustainably. The agricultural ingredients we use to produce our beverages require significant water resources and produce greenhouse gases. By working with our suppliers to reduce water use and implement regenerative farm practices that protect land and watersheds, we are enabling the natural ecosystem to sequester carbon while building resilience to temperature changes. | |

|

People & Communities |

We aim to improve people’s lives and create a better shared future for our communities and the planet. From ingredient sourcing to packaging recovery to creating local economic opportunities, we strive to create shared value through growth, with an ongoing focus on building inclusion and increasing people’s access to equal opportunities. |

To learn more about the Company’s sustainability efforts, including our comprehensive ESG goals, please view our Business & ESG Report on the Company’s website, by visiting www.coca-colacompany.com/sustainable-business.

|

||

|

The Board, through the ESG and Public Policy Committee, oversees the Company’s ESG strategies and initiatives, including the Company’s short- and long-term goals. See page 27 for information regarding the Board’s oversight of ESG matters, including sustainability. |

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 9 |

|

| 4 | Voting Roadmap |

|

|

|||

|

ITEM |

Election of Directors The Board of Directors and the Committee on Directors and Corporate Governance believe that the 11 Director nominees possess the necessary qualifications and experiences to provide quality advice and counsel to the Company’s management and effectively oversee the business and the long-term interests of shareowners. | ||

|

Our Board recommends a vote FOR each Director nominee See page 12 for further information | ||

|

|

|||

|

ITEM |

Advisory Vote to Approve Executive Compensation The Company seeks a non-binding advisory vote to approve the compensation of its Named Executive Officers as described in the Compensation Discussion and Analysis beginning on page 50 and the Compensation Tables beginning on page 67. | ||

|

Our Board recommends a vote FOR this item See page 46 for further information | ||

|

|

|||

|

ITEM |

Ratification of the Appointment of Ernst & Young LLP as Independent Auditors The Board of Directors and the Audit Committee believe that the retention of Ernst & Young LLP to serve as the Independent Auditors for the fiscal year ending December 31, 2022 is in the best interest of the Company and its shareowners. As a matter of good corporate governance, shareowners are being asked to ratify the Audit Committee’s selection of the Independent Auditors. | ||

|

Our Board recommends a vote FOR this item See page 87 for further information | ||

|

|

|||

|

ITEMS |

Shareowner Proposals Three proposals were submitted by shareowners. ●Proposal regarding an external public health impact disclosure

●Proposal regarding a global transparency report

●Proposal regarding an independent Board Chair policy

If a shareowner proponent, or a representative who is qualified under state law, is present and submits a proposal for a vote, then the proposal will be voted on at the 2022 Annual Meeting. | ||

|

Our Board recommends a vote AGAINST each of the shareowner proposals See page 90 for further information | ||

| 10 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

| 5 | Governance |

|

“Our Board understands that strong, independent Board leadership goes hand-in-hand with building long-term shareowner value.” | |||

|

Letter from Our Lead Independent Director MY FELLOW SHAREOWNERS: I am honored to serve as your Lead Independent Director and am grateful for the trust you have placed in me. | ||||||

|

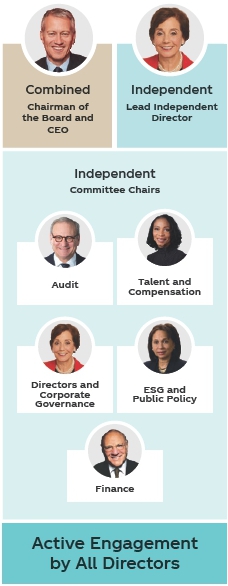

The role of Lead Independent Director is critical to a well-functioning Board. Our Board understands that strong, independent Board leadership goes hand-in-hand with building long-term shareowner value. The Board has been thoughtful in structuring the Lead Independent Director’s role with robust and clearly defined responsibilities. Importantly, we have been informed by what we have heard from shareowners. The Lead Independent Director plays a key role in helping guide the Board as it exercises its core duties in overseeing the Company’s business strategy and risks. This role also provides the key point of contact at the Board level for shareowners. Other duties include leading the performance evaluation of the Chairman and CEO; leading the annual Board evaluation process; presiding at executive sessions and at each meeting where the Chairman and CEO is not present; approving all Board agendas and information sent to the Board and playing a key role in Board and management succession. A full listing of the responsibilities is on page 29 of this Proxy Statement. Our Board is intently focused on actively engaging with James Quincey in a partnership to ensure the Company is strategically positioned to grow successfully and sustainably, always maintaining a focus on doing business the right way. We have great confidence in James and our capable management team. |

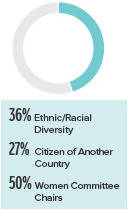

Today, I believe we are a diverse, well-functioning Board composed of capable Directors with the right mix of skills. I am intent on ensuring the Board remains comprised of Directors equipped to oversee the success of the business. We have a good foundation of Board refreshment that helps ensure Board composition remains aligned with the evolving needs of the business. Through a robust Director selection process and regular Board, Committee and Director evaluations, we strive to maintain an appropriate balance of tenure, diversity and skills. We value fresh perspectives, and we also value that, over time, Directors develop a deeper understanding of the Company and its business and an ability to work effectively as a group. Board refreshment is a journey, not a destination, and we will continue to field the best Board possible. I am particularly proud that in the past seven years, six new Directors have joined the Board. If the shareowners elect the nominees listed in this Proxy Statement, the average tenure for our Directors will stand at 8.4 years, and our Board’s gender diversity will be 45%. Our Board is now the most gender-diverse it has ever been, with a strong reservoir of experience. Our Board believes that culture, talent and sustainability have strategic significance in our long-term success. This Proxy Statement outlines the most current | |||||

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 11 |

|

|

step we have taken in this regard: to tie executive compensation more effectively to our sustainability and diversity, equity and inclusion goals, which is another Board action that is informed by shareowner input. Our Board understands that shareowners expect to have line of sight into decisions made in the boardroom. We agree that they should. I believe our robust, year-round shareowner engagement efforts have built valuable relationships and trust over time with our shareowners. We are committed to our shareowner engagement programs and investor communication efforts, and we value the opportunity to strengthen further our engagement with shareowners. Finally, we recognize that Board leadership structure is an important issue for many |

shareowners. Every year, the Lead Independent Director leads an executive session of non-management Directors to consider whether the position of Chair should be held by the CEO or be separated. Today, we believe the Company’s Board leadership structure with a combined Chair and CEO, balanced by a strong Lead Independent Director, will deliver the best results for our business and our shareowners. Thank you for your support, your interest and your investment in The Coca-Cola Company.

|

|

“We are committed to our shareowner engagement programs and investor communication efforts, and we value the opportunity to strengthen further our engagement with shareowners.” |

|

| 12 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

|

●Herb Allen

●Marc Bolland

●Ana Botín

|

●Christopher C. Davis

●Barry Diller

●Helene D. Gayle

|

●Alexis M. Herman

●Maria Elena Lagomasino

●James Quincey

|

●Caroline J. Tsay

●David B. Weinberg

|

The Board currently has 12 members. Robert A. Kotick is not standing for reelection and will retire from the Board immediately following the 2022 Annual Meeting of Shareowners, at which time the size of the Board will be reduced to 11 members.

All nominees are independent under the New York Stock Exchange (the “NYSE”) corporate governance rules, except for James Quincey (see Director Independence and Related Person Transactions beginning on page 40).

We have no reason to believe that any of the nominees will be unable or unwilling to serve, if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted for another person nominated as a substitute by the Board, or the Board may reduce the number of Directors.

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 13 |

|

Our 2022 Director Nominees

| (1) |

Includes Banco Santander, S.A. and its wholly owned subsidiary, Santander Holdings USA, Inc. |

| (2) |

Includes investment company directorships in Selected Funds, Davis Funds and Clipper Funds Trust, three fund complexes which are advised by Davis Selected Advisers, L.P. and other entities controlled by Davis Selected Advisers, L.P. |

| 14 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

BUILDING THE RIGHT BOARD FOR

THE COCA-COLA COMPANY

Nominee Demographics

| AVERAGE AGE 63.5 years |

AVERAGE TENURE 8.4 years |

DIVERSITY 45% women |

|

|

|

Nominee Attributes and Skills

THE RIGHT ATTRIBUTES TO OVERSEE THE BUSINESS

All Director nominees exhibit:

| ● | High integrity |

| ● | An appreciation of multiple cultures |

| ● | A commitment to sustainability and social issues |

| ● | Innovative thinking |

| ● | A proven record of success |

| ● | Knowledge of corporate governance requirements and practices |

THE RIGHT SKILLS TO CONSTRUCTIVELY CHALLENGE

MANAGEMENT AND GUIDE OUR BUSINESS STRATEGY

|

11 out of 11 |

|

4 out of 11 | |||

| High Level of Financial Experience |

Extensive Knowledge of the Company’s Business and/or Industry | |||||

|

9 out of 11 |

|

5 out of 11 | |||

| Broad International Exposure/ Emerging Market Experience |

Innovation/Technology Experience | |||||

|

11 out of 11 |

|

7 out of 11 | |||

| Risk Oversight/Management Expertise |

Governmental or Geopolitical Expertise | |||||

|

6 out of 11 |

|

11 out of 11 | |||

| Marketing Experience | Relevant Senior Leadership/ Chief Executive Officer Experience | |||||

|

7 out of 11 | |||||

| ESG Experience | ||||||

We are committed to good corporate governance, which promotes the long-term interests of shareowners, strengthens Board and management accountability, and helps build public trust in the Company. Our governance framework includes the following highlights:

| BOARD PRACTICES | ||

|

●10 of 11 Director nominees independent

●Demonstrated commitment to Board refreshment (since 2015, six new Directors have joined and nine Directors have rolled off)

●Demonstrated commitment to periodic committee refreshment and committee chair succession (since 2019, new chairs have been appointed on four of our committees)

●Robust Director nominee selection process

●Regular Board, committee and Director evaluations

●Annual election of Directors with majority voting standard

●Lead Independent Director elected by the independent Directors

●Independent Audit, Compensation and Governance Committees

●Regular executive sessions of non-employee Directors

●Strategy and risk oversight by full Board and committees

| ||

| SHAREOWNER MATTERS | ||

|

●Long-standing, active shareowner engagement

●Annual “say on pay” advisory vote

●Majority voting with resignation policy for Directors in uncontested elections

●Proxy access right

●Shareowner right to call special meetings

| ||

| OTHER BEST PRACTICES | ||

|

●Long-standing commitment to sustainability and other ESG matters

●Board oversight of human capital management and culture, including DEI

●Transparent public policy engagement

●Stock ownership guidelines for executives and stock holding requirements for Directors

●Anti-hedging, anti-short sale and anti-pledging policies

●Clawback policy for incentive awards

| ||

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 15 |

|

The Board and the Committee on Directors and Corporate Governance believe that there are general qualifications that all Directors must exhibit and other key qualifications and experiences that should be represented on the Board as a whole but not necessarily by each individual Director.

QUALIFICATIONS REQUIRED OF ALL DIRECTORS

The Board and the Committee on Directors and Corporate Governance require that each Director be a recognized person of high integrity with a proven record of success in his or her field and be able to devote the time and effort necessary to fulfill his or her responsibilities to the Company. Each Director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple cultures, and a commitment to sustainability and to dealing responsibly with social issues. In addition, potential Director candidates are interviewed to assess intangible qualities, including the individual’s ability to ask difficult questions and, simultaneously, to work collegially.

KEY QUALIFICATIONS AND EXPERIENCES TO BE REPRESENTED ON THE BOARD

The Board has identified key qualifications and experiences that are important to be represented on the Board as a whole, in light of the Company’s business strategy and expected future business needs. The table below summarizes how these key qualifications and experiences are linked to our Company’s business.

| Business Characteristics | Key Qualifications and Experiences | ||

| The Company’s business is multifaceted and involves complex financial transactions in many countries and in many currencies. |

|

High level of financial experience | |

|

Relevant senior leadership/ Chief Executive Officer experience | ||

| Marketing and innovation are focus areas of the Company’s business, and the Company seeks to develop and deploy the world’s most effective marketing and innovative products and technology. |

|

Marketing experience | |

|

Innovation/technology experience | ||

| The Company’s business is truly global and multicultural, with its products sold in more than 200 countries and territories around the world. |

|

Broad international exposure/ emerging market experience | |

| The Company’s business requires compliance with a variety of regulatory requirements across a number of countries and the ability to maintain relationships with various governmental entities and nongovernmental organizations. |

|

Governmental or geopolitical expertise | |

| The Company’s business is a complicated global enterprise, and most of the Company’s products are manufactured and sold by bottling partners around the world. |

|

Extensive knowledge of the Company’s business and/or industry | |

| The Board’s responsibilities include understanding and overseeing the various risks facing the Company and ensuring that appropriate policies and procedures are in place to effectively manage risk. |

|

Risk oversight/management expertise | |

| The Company’s large size and global scope present both opportunities and challenges to advancing our sustainability initiatives in the communities where we operate. |

|

ESG experience | |

CONSIDERATION OF DIVERSITY

The Board does not have a specific diversity policy but fully appreciates the value of Board diversity. Diversity is important because having a variety of points of view improves the quality of dialogue, contributes to a more effective decision-making process and enhances overall culture in the boardroom.

In evaluating candidates for Board membership, the Board and the Committee on Directors and Corporate Governance consider many factors based on the specific needs of the business and what is in the best interests of the Company’s shareowners. This includes diversity of professional experience, race, ethnicity, gender, age and cultural background. In addition, the Board and the Committee on Directors and Corporate Governance focus on how the experiences and skill sets of each Director nominee complement those of fellow Director nominees to create a balanced Board with diverse viewpoints and deep expertise.

| 16 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

The Committee on Directors and Corporate Governance is responsible for recommending to the Board a slate of nominees for election at each Annual Meeting of Shareowners. The Committee on Directors and Corporate Governance considers a wide range of factors when assessing potential Director nominees. This assessment includes a review of the potential nominee’s judgment, experiences, independence, understanding of the Company’s business or other related industries, and such other factors as the Committee concludes are pertinent in light of the current needs of the Board. A potential nominee’s qualifications are considered to determine whether they meet the qualifications required of all Directors and the key qualifications and experiences to be represented on the Board, as described above. Further, the Committee on Directors and Corporate Governance assesses how each potential nominee would impact the skills and experiences represented on the Board as a whole in the context of the Board’s overall composition and the Company’s current and future needs.

BOARD COMPOSITION AND REFRESHMENT

When recommending to the Board the slate of Director nominees for election at the Annual Meeting of Shareowners, the Committee on Directors and Corporate Governance strives to maintain an appropriate balance of tenure, diversity and skills on the Board.

The Board believes that refreshment, including periodic committee rotation, is important to help ensure that Board composition is aligned with the needs of the Company and the Board as our business evolves over time, and that fresh viewpoints and perspectives are regularly considered. The Board also believes that over time Directors develop an understanding of the Company and an ability to work effectively as a group. Because this provides significant value, a degree of continuity year-over-year is beneficial to shareowners and generally should be expected.

Directors are elected each year, at the Annual Meeting of Shareowners, to hold office until the next Annual Meeting of Shareowners and until their successors are elected and qualified. Because term limits could cause the loss of experience or expertise important to the optimal operation of the Board, there are no absolute limits on the length of time that a Director may serve, but the Committee on Directors and Corporate Governance and the Board consider the tenure of Directors as one of several factors in nomination decisions. In addition, the Committee on Directors and Corporate Governance evaluates the qualifications and performance of each incumbent Director before recommending the nomination of that Director for an additional term. Furthermore, pursuant to our Corporate Governance Guidelines, Directors whose job responsibilities change or who reach the age of 74 are asked to submit a letter of resignation to the Board. These letters are considered by the Board and, if applicable, annually thereafter. The Committee on Directors and Corporate Governance has reviewed the Director nominees who were 74 years of age or older and determined to recommend them for reelection based on their skills, qualifications and experiences.

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 17 |

|

SHAREOWNER-RECOMMENDED DIRECTOR CANDIDATES

Shareowners who would like the Committee on Directors and Corporate Governance to consider their recommendations for nominees for the position of Director should submit their recommendations in writing by mail to the Committee on Directors and Corporate Governance in care of the Office of the Secretary, The Coca-Cola Company, P.O. Box 1734, Atlanta, Georgia 30301 or by email to asktheboard@coca-cola.com. Recommendations by shareowners that are made in accordance with these procedures will receive the same consideration by the Committee on Directors and Corporate Governance as other suggested nominees.

SHAREOWNER-NOMINATED DIRECTOR CANDIDATES

We have a “Proxy Access for Director Nominations” by-law. The proxy access by-law permits a shareowner, or a group of up to 20 shareowners, owning 3% or more of the Company’s outstanding Common Stock continuously for at least three years to nominate and include in the Company’s proxy materials Director nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the shareowner(s) and the nominee(s) satisfy the requirements specified in Article I, Section 12 of our By-Laws. See question 30 on page 106 for more information.

MAJORITY VOTING STANDARD

Our By-Laws provide that, in an election of Directors where the number of nominees does not exceed the number of Directors to be elected, each Director must receive the majority of the votes cast with respect to that Director. If a Director does not receive a majority vote, he or she has agreed that he or she would submit a letter of resignation to the Board. The Committee on Directors and Corporate Governance would make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board would act on the resignation taking into account the recommendation of the Committee on Directors and Corporate Governance, which would include consideration of the vote and any relevant input from shareowners. The Board would publicly disclose its decision and its rationale within 100 days of the certification of the election results. The Director who tenders his or her resignation would not participate in the decisions of the Committee on Directors and Corporate Governance or the Board that concern the resignation.

| 18 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

Biographical Information About Our Director Nominees

Included in each Director nominee’s biography that follows is a description of five key qualifications and experiences of such nominee. Many of our Director nominees have more than five qualifications, and the aggregate number for all Director nominees is reflected on page 14. The Board and the Committee on Directors and Corporate Governance believe that the combination of the various qualifications and experiences of the Director nominees would contribute to an effective and well-functioning Board and that, individually and as a whole, the Director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

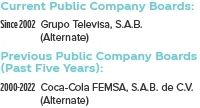

| Herb Allen | CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 54 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience Extensive experience supervising business operations, including financial advisory and investment banking services to public and private companies at Allen & Company LLC. Supervises Allen & Company LLC’s principal financial and accounting officers on all matters related to the firm’s financial position and results of operations as well as the presentation of its financial statements. |

|

Relevant Senior Leadership/Chief Executive Officer Experience President of Allen & Company LLC, a privately held investment banking firm, and its affiliate, Allen Investment Management LLC, a privately held investment advisory firm, since 2002. | ||

|

Innovation/Technology Experience Extensive entrepreneurial experience overseeing investments by Allen & Company LLC into early-stage companies focusing on technologies, including e-commerce, data analytics, cybersecurity, artificial intelligence, biotechnology and SaaS technologies. | ||

|

Broad International Exposure/Emerging Market Experience Considerable international experience as President of Allen & Company LLC working with international clients on mergers and acquisitions, capital markets and other advisory assignments with a focus on European and Latin American clients. | ||

|

Risk Oversight/Management Expertise Extensive risk and management experience as President of Allen & Company LLC, including overseeing and assessing the performance of companies and public accountants with respect to matters related to the preparation, audit and evaluation of financial statements. | ||

|

Chair |

|

Member |

|

Audit Committee |

|

Talent and Compensation Committee |

|

Committee on Directors and Corporate Governance |

|

Finance Committee |

|

ESG and Public Policy Committee |

|

Executive Committee |

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 19 |

|

Marc Bolland |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 62 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience Extensive operational and financial experience as Chief Executive Officer of Marks & Spencer Group p.l.c., Chief Executive Officer of WM Morrison Supermarkets PLC, Chief Operating Officer of Heineken N.V. and Head of European Portfolio Operations of The Blackstone Group Inc., all public companies. |

|

Broad International Exposure/Emerging Market Experience Served as lead non-executive director of the U.K. Department for International Development from 2018-2020; led international expansion of Marks & Spencer Group p.l.c.; and held several international management positions while at Heineken N.V. | ||

|

Extensive Knowledge of the Company’s Business and/or Industry Nineteen years in the global beverage industry, with significant operations experience, including service as Chief Operating Officer of Heineken N.V. Ten years of experience in the retail industry, including service as Chief Executive Officer of a supermarket chain in the U.K. | ||

|

Risk Oversight/Management Expertise Extensive experience overseeing risk as Chief Executive Officer of Marks & Spencer Group p.l.c. and WM Morrison Supermarkets PLC, as Chief Operating Officer of Heineken N.V. and as a Director of International Consolidated Airlines Group, S.A., which offers international and domestic air passenger and cargo transportation services. Additional risk management experience as head of The Blackstone Group Inc.’s European Portfolio Operations, as Chairman of The Blackstone Group International Partners LLP, a subsidiary, which acts as a sub-advisor to Blackstone U.S. affiliates in relation to the investment and re-investment of Europe, Middle East and Africa-based assets of Blackstone funds. | ||

|

ESG Experience Chair of Polymateria, a privately owned British company specializing in breakthrough plastic biotransformation technology, since September 2019. Won “World Sustainable Retailer of the Year” three times while CEO of Marks & Spencer Group p.l.c. Founder of the Movement to Work charity, which has provided over 100,000 underprivileged young people with work experience. | ||

|

Chair |

|

Member |

|

Audit Committee |

|

Talent and Compensation Committee |

|

Committee on Directors and Corporate Governance |

|

Finance Committee |

|

ESG and Public Policy Committee |

|

Executive Committee |

| 20 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

Ana Botín |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 61 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience Internationally recognized expert in the investment banking industry with knowledge of global macroeconomic issues. Over 40 years of experience in investment and commercial banking. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Executive Chair of Banco Santander, S.A. since September 2014 and Chief Executive Officer of Santander UK plc from 2010 to September 2014. | ||

|

Broad International Exposure/Emerging Market Experience Executive Chair of Banco Santander, S.A., a global financial institution with operations in Europe, North America, Latin America and Asia. Board member of the Institute of International Finance, a global association of the financial industry. Co-founder and Chair of Fundación Empresa y Crecimiento, which finances small and medium-sized companies in Latin America. Founder and President of Fundación Empieza Por Educar, the Spanish member of the global Teach for All network. | ||

|

Governmental or Geopolitical Expertise Extensive experience with the regulatory framework applicable to banking institutions throughout the globe. President of the European Banking Federation since 2021. | ||

|

Risk Oversight/Management Expertise Extensive experience from her work with Banco Santander, S.A., Santander UK plc and Banco Español de Crédito, S.A. in the oversight and management of risks associated with retail and commercial banking activities. Experience with the regulated insurance industry as director of Assicurazioni Generali S.p.A., a global insurance company based in Italy, from 2004 to 2011. | ||

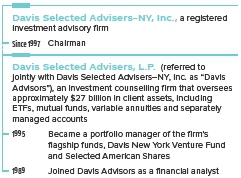

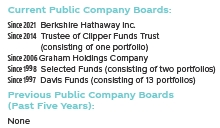

Christopher C. Davis |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 56 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience More than 30 years of experience in investment management and securities research at Davis Advisors. Also serves as a portfolio manager for the Davis Large Cap Value Portfolios and a member of the research team for other portfolios. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chairman of Davis Selected Advisers–NY, Inc., and as a Director and officer of several mutual funds advised by Davis Advisors, as well as other entities controlled by Davis Advisors. | ||

|

Marketing Experience Under the leadership of Mr. Davis, Davis Advisors is widely recognized as a premier investment manager serving individual investors worldwide, identifying investment opportunities both within and outside the United States in developed and developing markets and providing investors access to these investment opportunities. | ||

|

Broad International Exposure/Emerging Market Experience Under the leadership of Mr. Davis, Davis Advisors seeks investment growth opportunities and diversification potential that international companies in both developed and developing markets provide. | ||

|

Risk Oversight/Management Expertise Extensive experience evaluating strategic investments and transactions and managing risk against the volatility of equity markets during his more than 30-year career at Davis Advisors. Serves on the Audit Committee and as lead independent director of Graham Holdings Company and serves on the Audit Committee of Berkshire Hathaway Inc. | ||

|

Chair |

|

Member |

|

Audit Committee |

|

Talent and Compensation Committee |

|

Committee on Directors and Corporate Governance |

|

Finance Committee |

|

ESG and Public Policy Committee |

|

Executive Committee |

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 21 |

|

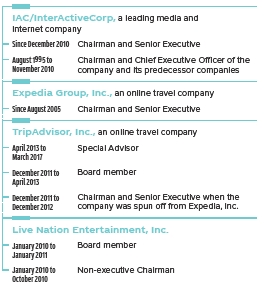

Barry Diller |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 80 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience Extensive experience in financings, mergers, acquisitions, investments and strategic transactions, including transactions with Silver King Broadcasting, QVC, Inc., Ticketmaster Entertainment, Inc. and Home Shopping Network, Inc. Served on the Finance Committee of Graham Holdings Company. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chairman and Senior Executive of IAC/InterActiveCorp. Served as Chief Executive Officer of Fox, Inc. from 1984 to 1992, responsible for the creation of Fox Broadcasting Company, and Fox’s motion picture operations. Prior to Fox, served for ten years as Chief Executive Officer of Paramount Pictures Corporation. | ||

|

Marketing Experience Serves as Chairman and Senior Executive at IAC/InterActiveCorp, comprised of category-leading businesses including Angi Inc., Dotdash Meredith and Care.com, and at Expedia Group, Inc., which markets a variety of leisure and business travel products. | ||

|

Innovation/Technology Experience Extensive experience in the media and Internet sectors, including experience at IAC/InterActiveCorp, with businesses in the marketing and technology industries, at Expedia Group, Inc., which empowers travelers through technology with tools to efficiently research, plan, book and experience travel, and at TripAdvisor, Inc., which operates the flagship TripAdvisor-branded websites and numerous other travel brands. | ||

|

Broad International Exposure/Emerging Market Experience Service at IAC/InterActiveCorp, a leading media and Internet company that is home to dozens of popular digital brands and services used by millions of consumers each day, and at online travel company Expedia Group, Inc. | ||

Helene D. Gayle |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 66 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

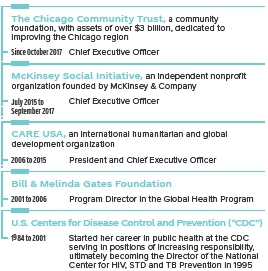

Relevant Senior Leadership/Chief Executive Officer Experience Served as Chief Executive Officer of The Chicago Community Trust, former Chief Executive Officer of McKinsey Social Initiative and former President and Chief Executive Officer of CARE USA. |

|

Broad International Exposure/Emerging Market Experience Implemented the McKinsey Social Initiative’s Generation program. Experience managing international operations at CARE USA. Helped develop global health initiatives in leadership roles at the CDC and the Bill & Melinda Gates Foundation. Serves on the Board of Trustees of the Center for Strategic and International Studies and the Brookings Institution. Member of the National Academy of Medicine and of the Council on Foreign Relations. | ||

|

Governmental or Geopolitical Expertise Extensive leadership experience in the global public health and development fields. Served as Chair of the Obama administration’s Presidential Advisory Council on HIV/AIDS. Member of the U.S. Department of State’s Advisory Committee on International Economic Policy and the Secretary of State’s Advisory Committee on Public-Private Partnerships. Served on the President’s Commission on White House Fellowships. Achieved the rank of Assistant Surgeon General and Rear Admiral in the U.S. Public Health Service. Serves as a Director of New America Foundation and ONE. | ||

|

Risk Oversight/Management Expertise Extensive risk oversight and management experience with the delivery of emergency relief and long-term international development projects in the global public health field. Director of the Federal Reserve Bank of Chicago, which participates in the formulation of monetary policy, one of 12 regional reserve banks across the United States that, together with the Board of Governors in Washington, D.C., serves as the central bank for the United States. | ||

|

ESG Experience As CEO of The Chicago Community Trust, leads the Trust’s efforts to close the racial and ethnic wealth gap in the Chicago region. Significant experience in public health initiatives and humanitarian efforts from over 20 years of leadership positions at various nonprofit organizations. | ||

|

Chair |

|

Member |

|

Audit Committee |

|

Talent and Compensation Committee |

|

Committee on Directors and Corporate Governance |

|

Finance Committee |

|

ESG and Public Policy Committee |

|

Executive Committee |

| 22 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

Alexis M. Herman |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 74 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

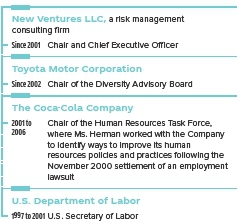

High Level of Financial Experience Significant financial experience as Chief Executive Officer of New Ventures LLC and as Chair of the Working Party for the Role of Women in the Economy for the Organisation for Economic Co-operation and Development (“OECD”), an intergovernmental economic organization. Additional financial experience through former service on the Audit Committee of MGM Resorts International, a global hospitality company. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Chief Executive Officer of New Ventures LLC. Former U.S. Secretary of Labor from 1997 to 2001. | ||

|

Governmental or Geopolitical Expertise Former U.S. Secretary of Labor. Former White House Assistant to President Clinton and Director of the White House Office of Public Liaison. Served as Director of the Labor Department’s Women’s Bureau under President Jimmy Carter. Former Chief of Staff and former Vice Chair of the Democratic National Committee. Served as a Trustee of the Clinton Bush Haiti Fund and as Chair of the Working Party for the Role of Women in the Economy for the OECD. Serves on the Corporate Social Responsibility Committee for MGM Resorts International. | ||

|

Risk Oversight/Management Expertise Significant expertise in management and oversight of labor and human relations risks, including handling the United Parcel Service workers’ strike in 1997 while U.S. Secretary of Labor. Chair of the Company’s Human Resources Task Force following the November 2000 settlement of an employment lawsuit. Serves as Lead Director and is a member of the Finance Committee of Cummins Inc. and served as Chair of the Business Advisory Board at Sodexo, Inc. | ||

|

ESG Experience Serves as Chair of Toyota’s Diversity Advisory Board. Served as Chair of the Working Party for the Role of Women in the Economy for the OECD. Former U.S. Secretary of Labor. | ||

Maria Elena Lagomasino |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 72 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

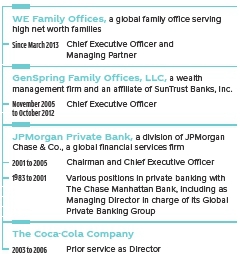

High Level of Financial Experience Over 38 years of experience in the financial industry and a recognized leader in the wealth management industry. Chief Executive Officer and Managing Partner of WE Family Offices. Former Chief Executive Officer of GenSpring Family Offices, LLC. Founding member of the Institute for the Fiduciary Standard, a nonprofit formed in 2011 to provide research, education and advocacy of the fiduciary standard’s importance to investors receiving investment and financial advice. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chief Executive Officer of WE Family Offices and served as Chief Executive Officer of GenSpring Family Offices, LLC and JPMorgan Private Bank. | ||

|

Broad International Exposure/Emerging Market Experience Significant international experience in GenSpring Family Offices, LLC and JPMorgan Private Bank. During her tenure with The Chase Manhattan Bank, served as Managing Director of the Global Private Banking Group, Vice President of private banking in the Latin America region and head of private banking for the western hemisphere. Over 40 years of experience working with Latin America. Exposure to international issues as a former Board member of the Americas Society and the Cuba Study Group, as a former Trustee of the National Geographic Society and as a member of the Council on Foreign Relations. | ||

|

Governmental or Geopolitical Expertise Experience with regulatory framework applicable to banking institutions in Latin America during her tenure with The Chase Manhattan Bank, and as Chief Executive Officer of JPMorgan Private Bank. Exposure to international geopolitical issues in the Americas Society, Cuba Study Group and the Council on Foreign Relations. | ||

|

Risk Oversight/Management Expertise Extensive oversight of risk associated with wealth management and investment strategies in WE Family Offices, GenSpring Family Offices, LLC and JPMorgan Private Bank. | ||

|

Chair |

|

Member |

|

Audit Committee |

|

Talent and Compensation Committee |

|

Committee on Directors and Corporate Governance |

|

Finance Committee |

|

ESG and Public Policy Committee |

|

Executive Committee |

| Notice of 2022 Annual Meeting of Shareowners |

Letter From Our Chairman and Chief Executive Officer |

Refresh The World. Make A Difference. |

Voting Roadmap |

Governance | Share Ownership |

Compensation | Audit Matters |

Shareowner Proposals |

Annexes | 23 |

|

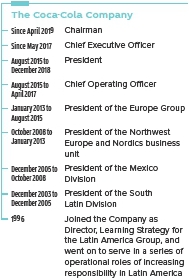

| James Quincey | CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

CHAIRMAN  Age: 57 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience Extensive financial experience acquired through various leadership positions in the Company, managing complex financial transactions, mergers and acquisitions, business strategy and international operations. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Chief Executive Officer of the Company since May 2017. Served as President from August 2015 to December 2018, Chief Operating Officer from August 2015 to April 2017 and President of the Europe Group from January 2013 to August 2015. Chairman of the Board of the Company since April 2019. | ||

|

Innovation/Technology Experience As President of the Europe Group, implemented innovative strategies to improve the Company’s execution and brand portfolio. As President of the Northwest Europe and Nordics business unit, oversaw the Company’s acquisition of innocent juice in 2009. During his tenure in Latin America, was instrumental in developing and executing a successful brand, pack, price and channel strategy, which has now been replicated in various forms throughout the Company’s global system, and in creating the Company’s current juice platform in Mexico under the Del Valle trademark through joint ventures with the Company’s bottling partners. | ||

|

Broad International Exposure/Emerging Market Experience Over 25 years of Coca-Cola system experience, including extensive experience in international markets, such as Latin America and Europe. Responsibility for all of the Company’s operating units worldwide as President and Chief Operating Officer and, currently, as Chief Executive Officer. Member of the Board of Directors of the US-China Business Council, the Consumer Goods Forum and Pfizer Inc. | ||

|

Extensive Knowledge of the Company’s Business and/ or Industry Since joining the Company in 1996, has held a multitude of operational roles within the Coca-Cola system, including as Chairman of the Board, Chief Executive Officer, President and Chief Operating Officer. | ||

| Caroline J. Tsay | CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 40 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience Managed profit and loss as Chief Executive Officer of Compute Software, Inc. and, in her position at HPE, responsible for growing enterprise software sales. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chief Executive Officer of Compute Software, Inc. and served as Vice President and General Manager of Software at HPE. | ||

|

Marketing Experience At Compute Software, Inc., is responsible for developing an enterprise software platform for customers running on the cloud. At HPE, was responsible for engaging customers and partners through several new digital experiences, digital marketing, and specialized sales models to drive growth in new customers and revenue. At Yahoo! Inc., held leadership positions across the consumer search, e-commerce and advertising businesses. | ||

|

Innovation/Technology Experience At Compute Software, Inc., is responsible for developing the artificial intelligence and decision sciences-based software platform that dynamically optimizes cloud resource decisions and maximizes business value for companies running on the cloud. At HPE, created a new business and platform for offering customers enterprise software, including DevOps, Cybersecurity, Big Data and Application Development software. At Yahoo! Inc., was Senior Director of Product Management for Yahoo! Search and E-Commerce where she launched consumer Internet innovations that drove 500 million daily visits and $3.5 billion in revenue. Prior to Yahoo! Inc., spent three years at International Business Machines Corporation as a senior consultant focused on providing supply chain solutions to clients in the retail, high tech, and travel industries. Recognized as one of The National Diversity Council’s 2015 Top 50 Most Powerful Women in Technology. | ||

|

Risk Oversight/Management Expertise Extensive experience overseeing risk associated with the development and growth of enterprise software and consumer Internet businesses at Compute Software, Inc., and in her product leadership roles with HPE and Yahoo! Inc. Risk oversight experience through service on the Audit Committee of Morningstar, Inc. and as Chair of the Business Advisory Committee at Rosetta Stone Inc. | ||

|

Chair |

|

Member |

|

Audit Committee |

|

Talent and Compensation Committee |

|

Committee on Directors and Corporate Governance |

|

Finance Committee |

|

ESG and Public Policy Committee |

|

Executive Committee |

| 24 | THE COCA-COLA COMPANY 2022 PROXY STATEMENT |

| David B. Weinberg |

CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

INDEPENDENT  Age: 70 Committees: |

PUBLIC BOARD MEMBERSHIPS  |

|

High Level of Financial Experience In his position at Judd Enterprises, Inc., oversees substantial assets in a wide variety of asset classes. Significant experience in reviewing financial statements as an investor and as a securities lawyer when structuring transactions. Previously served on the Audit Committee and currently serves on the Executive, Finance and Investments Committees of the Board of Trustees of Northwestern University. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Since 1996, has served as Chairman and Chief Executive Officer of Judd Enterprises, Inc. and President of Digital Bandwidth LLC. | ||

|

Innovation/Technology Experience Extensive entrepreneurial experience in Digital Bandwidth LLC, overseeing investments in early-stage companies focusing on technologies, including wireless networks, speech recognition, cybersecurity and radio frequency identification tags. | ||

|