UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| | |

x

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2013 |

OR

|

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | FOR THE TRANSITION PERIOD FROM __________ TO ________ |

COMMISSION FILE NUMBER 001-35176

GLOBAL EAGLE ENTERTAINMENT INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 27-4757800 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

4553 Glencoe Avenue | | |

Los Angeles, California | | 90292 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 437-6000

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of each class Common Stock, $0.0001 par value | Name of each exchange on which registered The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer o | | Accelerated filer x | | Non-accelerated filer o | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the common stock held by non-affiliates of the registrant, computed as of June 30, 2013 (the last business day of the registrant’s most recently completed second fiscal quarter), was approximately $215,612,905.56.

As of March 25, 2014, there were 52,863,455 shares of the registrant’s shares of common stock issued and outstanding (excluding 3,053,634 shares of common stock held by AIA, a majority-owned subsidiary of the registrant) and 19,118,233 shares of the registrant’s shares of non-voting common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to the registrant’s 2014 Annual Meeting of Shareholders to be filed hereafter are incorporated by reference into Part III of this Annual Report on Form 10-K.

GLOBAL EAGLE ENTERTAINMENT INC.

INDEX TO FORM 10-K

YEAR ENDED DECEMBER 31, 2013

|

| | | | |

Item No. | | Description | | Page |

| | | | |

| | | | |

| | | | |

Item 1. | | | | |

Item 1A. | | | | |

Item 1B. | | | | |

Item 2. | | | | |

Item 3. | | | | |

Item 4. | | | | |

| | | | |

| | | | |

| | | | |

Item 5. | | | | |

Item 6. | | | | |

Item 7. | | | | |

Item 7A. | | | | |

Item 8. | | | | |

| | | | |

Item 9. | | | | |

Item 9A. | | | | |

Item 9B. | | | | |

| | | | |

| | | | |

| | | | |

Item 10. | | | | |

Item 11. | | | | |

Item 12. | | | | |

Item 13. | | | | |

Item 14. | | | | |

| | | | |

| | | | |

| | | | |

Item 15. | | | | |

| | | | |

Signatures | | | | |

PART I

ITEM 1. BUSINESS

Overview

Global Eagle Entertainment Inc. (the “Company”, “Global Eagle”, “GEE” “we”, “us”, or “our”) is the leading full service provider of connectivity and content to the worldwide airline industry. Our business is comprised of two operating segments: Connectivity and Content.

| |

• | Our Connectivity segment provides our airline partners and their passengers with Wi-Fi connectivity over Ku-band satellite transmissions. We operate our Connectivity business through our wholly-owned subsidiary, Row 44, Inc. ("Row 44"). Row 44 combines specialized network equipment, media applications and premium content services that allow airline passengers to access in-flight Internet, live television, on-demand content, shopping and travel-related information. With our connectivity solution currently installed on more than 500 aircraft, we have the largest fleet of in-flight entertainment and Internet connected aircraft capable of operating over land and sea. |

| |

• | Our Content segment selects, manages and distributes wholly-owned and licensed media content, video and music programming, applications and video games to over 120 airlines worldwide, as well as to the maritime and other away-from-home non-theatrical markets. We operate our Content business through our majority-owned subsidiary, Advanced Inflight Alliance AG (“AIA”), and other wholly-owned subsidiaries. |

Our Connectivity business generates revenue primarily through the sale of equipment and Wi-Fi Internet and related services. Our Content business generates revenue primarily through the licensing of acquired and third party media content, video and music programming, and video games, and secondarily from value added services such as selection, purchase, production, customer support and technical adjustment of content in connection with the integration and servicing of in-flight entertainment programs.

2013 Transactions

On January 31, 2013, we completed a business combination transaction (the “Business Combination”) in which we acquired all of the outstanding capital stock of Row 44 and 86% of the shares of AIA. We currently own approximately 94% of the shares of AIA, and expect to acquire the remaining 6% of the shares of AIA in the first half of 2014. See “Corporate History” below.

On July 9, 2013, we acquired substantially all of the assets of Post Modern Edit, LLC and related entities (such business, which we operate through wholly-owned subsidiaries, is referred to herein as "PMG") for approximately $10.6 million in cash, 431,734 shares of common stock and assumption of $3.3 million of debt, and subject to an earn-out as described in Note 3. Business Combination, to our consolidated financial statements included in Item 15. Exhibits and Financial Statement Schedules. PMG is a premier provider of digital media production and post-production services. PMG’s operations, which include AMP International, Ambient, Criterion Pictures and Sea Movies, provide video production, post-production and digital content delivery services spanning television shows, feature films, commercials, home video and live news broadcasts, as well as multi-language media for use in in-flight and cruise line entertainment systems. PMG serves Hollywood studios and distributors, advertising agencies, major corporations, federal and local government entities, airlines and cruise lines worldwide.

On October 18, 2013, we acquired the U.K.-based parent of IFE Services Limited (“IFES”) for approximately $36 million in cash. IFES is a leading provider of in-flight entertainment services to airlines and cruise lines worldwide. IFES supplies a full range of services to enable its clients to provide a first class entertainment experience to passengers, including movies, television programs, audio, games, 3D maps, safety and films, portable entertainment systems, onboard publications and audio- and video-on-demand technical support and management. We financed the acquisition of IFES through the issuance of a convertible note and the issuance of common stock as more fully described in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

Operating Segments

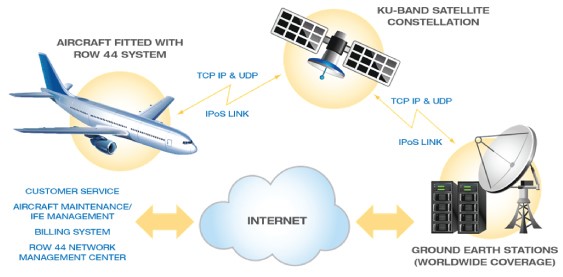

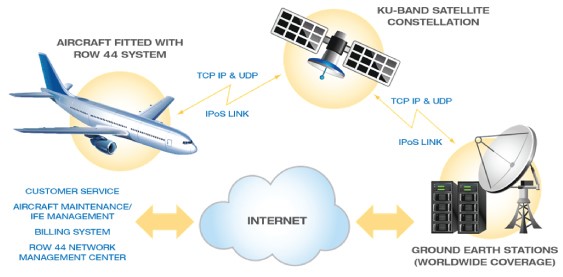

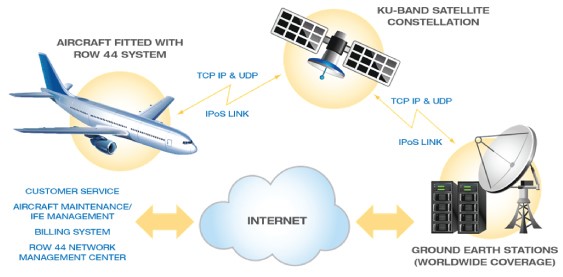

Connectivity

Through our wholly-owned subsidiary, Row 44, our Connectivity segment provides our airline partners and their passengers with Wi-Fi connectivity via satellite transmissions. Our connectivity system enables aircraft to connect to orbiting Ku-band satellites and to communicate with existing satellite ground earth stations. Our connectivity solution provides airline passengers with Wi-Fi based Internet access, live television, on-demand content, shopping, and flight and destination information.

Row 44 was formed in 2004, its Wi-Fi connectivity system was first deployed by a domestic commercial airline in 2009 and its broadband services became fully operational in 2010. Following the completion of its licensed and operational in-flight broadband system in 2010, Row 44 commenced installation of its equipment on Southwest Airlines and began to generate revenues from operations. Hughes Network Systems, LLC (“Hughes”), a global satellite services company, provides Row 44 exclusive satellite coverage across North America. With our connectivity solution currently installed on more than 500 aircraft, we have the largest fleet of in-flight entertainment and Internet connected aircraft capable of operating over both land and sea. In the near future, we also expect to deliver additional content and other desired communication services to airline passengers, and to provide airlines with valuable aircraft operations data and applications.

Row 44 has achieved the following customer milestones through March 2014:

| |

• | 2010 - Southwest Airlines Co.; |

| |

• | 2011 - Norwegian Air Shuttle; |

| |

• | 2011 - WirelessG (Mango Airlines); |

| |

• | 2012 - Transaero Airlines; |

| |

• | 2014 - Air China (trial) |

The combined satellite coverage with these customers spans from Alaska to Japan, covering North America, the North Atlantic, Europe, and a substantial portion of the Middle East, Russia and Asia.

Connectivity Segment Products and Services:

Satellite-Based Wi-Fi Internet Connectivity

We offer satellite-based Wi-Fi Internet connectivity in the United States and where permitted in other areas outside the United States where we are provided to provide service. Our service allows airline passengers to connect to the Internet through their personal Wi-Fi enabled devices gate-to-gate. We provide our airline customers flexibility in how they want to provide and price the service to their passengers. Our fee structure for Wi-Fi Internet service varies by airline, and is customarily in the form of (i) a set fee for each enplaned passenger, (ii) a fee based on usage by passengers or (iii) flat rates per installed aircraft. In order to implement our connectivity services, we also provide our airline customers the following:

| |

• | Connectivity Equipment - we sell and lease equipment that allows our satellite-based services to operate on aircraft. Our equipment is generally shipped and sold as a single kit, with components of the kits separately priced for future ordering. Significant components of our equipment kits include radomes, antennas, modems and provisional and activation packages. We offer installation support to our customers’ in-house or designated third party installers. Substantially all of our equipment is manufactured and warrantied by third party manufacturers. |

| |

• | Regulatory Support - we obtain Supplemental Type Certificates (“STCs”), which are certificates issued when an applicant has received Federal Aviation Administration (“FAA”) or similar international regulatory approval to modify an aircraft from its original type certificate approval. An STC on an aircraft type allows our equipment to be installed on that aircraft type. |

| |

• | Post-Implementation Support - once our equipment is installed and operational, we provide technical and network support, which includes 24/7 operational assistance and monitoring of the connectivity performance and bandwidth of our satellite-based services on each aircraft. |

Live Television Programming

In addition to Internet connectivity, we offer live television programming whereby airline passengers can watch a wide range of live television channels through their personal Wi-Fi enabled devices. Currently including up to 18 channels, our live television product includes a variety of programming options such as news channels, major broadcast networks and specialty

cable network channels. We also offer a selection of video-on-demand content in connection with our live television channels. Our fee structure for our live television package on our launch airline, Southwest Airlines, is currently based on a free to the passenger sponsorship model whereby we receive a fixed fee per month from Southwest for the duration of the sponsorship. Following the sponsorship, Southwest has the option to pay us (i) a set fee for each enplaned passenger to continue the free to the passenger service or (ii) a fee based on usage by passengers

Online Web-Portal Services

Included in our Wi-Fi Internet services are web portal services, which generally include a web home page and a variety of services for airline passengers to choose from once logged into our Wi-Fi Internet service through their personal Wi-Fi enabled devices. Our web portal service is white-labeled, which allows our airline customers to customize the home page with their own logo and branding. Through our web-portal services, we also offer (i) advertising, (ii) content for brands to sponsor such as the home page, music, texting, travel and or other related web pages, (iii) in-flight maps, music, destination and travel-related services and (iv) video on demand or “VOD.” VOD allows customers the ability to watch newly released feature films or television content in-flight and over their personal Wi-Fi enabled devices in exchange for a one-time fee. The fees generated from advertising, sponsored content, VOD and other portal services are generally subject to revenue sharing arrangements with our airline customers.

Ancillary Connectivity Products and Services

In order to implement our connectivity services, we also provide our airline customers the following:

| |

• | Connectivity Equipment - we sell equipment that allows our satellite-based services to operate on aircraft. Our equipment is generally shipped and sold as a single kit, with components of the kits separately priced for future ordering. Significant components of our equipment kits include radomes, antennas, modems and provisional and activation packages. We offer installation support to our customers’ in-house or designated third party installers. Substantially all of our equipment is manufactured and warrantied by third party manufacturers. |

| |

• | Regulatory Support - we obtain Supplemental Type Certificates (“STCs”), which are certificates issued when an applicant has received Federal Aviation Administration (“FAA”) or similar international regulatory approval to modify an aircraft from its original type certificate approval. An STC on an aircraft type allows our equipment to be installed on that aircraft type. |

| |

• | Post-Implementation Support - once our equipment is installed and operational, we provide technical and network support, which includes 24/7 operational assistance and monitoring of the connectivity performance and bandwidth of our satellite-based services on each aircraft. |

Wi-Fi VOD Delivery System

Starting in the first half of 2014, we plan to offer customers our Wireless In-flight Services and Entertainment (WISETM) solution, a Wi-Fi VOD solution. The WISE platform allows airlines to deliver newly released content through a Wi-Fi system that is native and embedded into the plane itself. By logging onto the WISE system, passengers will be able to access the latest VOD content through their personal Wi-Fi enabled devices without the potential for outside connectivity interruptions. Our WISE system is intended to serve as a lower cost alternative to our satellite Wi-Fi enabled services. We plan to offer the WISE solution with a wide-variety of features and services, including (i) the basic platform system, (ii) creative services for airline branding and customization of the base platform, (iii) content selection, processing and delivery services, (iv) application development and service delivery and (v) analytics services. By using the extensive product and service offerings of our Content business, we expect to deliver WISE as a complete end-to-end solution for our airline customers, and are continuing to develop additional features for the WISE platform.

Content

Our Content segment is operated through our majority-owned subsidiary, AIA, and other wholly-owned subsidiaries PMG and IFES. Our Content segment is a leader in the business of selecting, procuring, managing, encoding, and distributing video and music programming, and in providing e-readers and similar applications and video games to the in-flight entertainment market. We deliver content compatible with our systems as well as a multitude of third-party in-flight entertainment ("IFE") systems.

Our Content segment’s operations are primarily focused on:

| |

• | acquiring IFE licenses for major Hollywood and international film and television productions, and marketing such distribution rights to the airline, maritime and other non-theatrical markets such as schools; |

| |

• | making content available for IFE systems and all associated services; and |

| |

• | providing services ranging from the selection, purchase, production and technical adjustment of content to customer support in connection with the integration and servicing of IFE programs. |

Content Segment Products and Services

Licensing and Distribution

Our Content segment has been providing movies, television programming, games and audio programming as well as technical services for over 30 years. We source a broad range of theatrical and television programs from over 100 worldwide distributors including Warner Bros., NBC Universal, Twentieth Century Fox, CBS, Paramount, the BBC, Discovery and The Walt Disney Company, as well as smaller international content providers. Our programmers identify content that is relevant and appropriate for each individual airline based on their individual preferences. We tailor movie selections to create the atmosphere deemed appropriate by our individual airline customers.

Technical Services and Digital Production Solutions

Our Content segment addresses a variety of technical needs of airline relating to content irrespective of the particular onboard IFE system being used. We provide comprehensive support for a broad-range of traditional, new and emerging technologies. Our technical services include encoding, editing and meta-data services that we perform in-house in technical facilities in Singapore, Auckland (New Zealand), and California. These technical facilities also enable us to provide a full range of tailored digital production solutions including corporate videos, safety videos, animated video content, podcasts and broadcast quality radio shows. We maintain a robust global digital network, allowing us to transfer a wide-range of file formats to our customers worldwide in minutes. We also support analog systems for airlines running on older “legacy” systems, and can advise on "plug and play" replacement hardware to assist our customers in implementing more cost effective IFE hardware solutions. We can adapt content and databases to be compatible with a broad-range of devices and delivery methods, including tablets, streaming video, iOS, Android and others. We have also negotiated licensing agreements with both domestic and international rights holders for the use of materials on portable electronic devices.

Graphical User Interfaces

Our Content services also include the development of graphical user interfaces for a variety of in-flight entertainment applications, database management related to the overall management of in-flight entertainment and both the technical integration of content and the operation of the varied content management systems found on commercial aircraft across the globe.

Our subsidiary Inflight Productions Ltd ("IFP") is developing custom-built airline “micro-sites” to take the passenger experience beyond the onboard experience and onto the Internet. Through these dedicated websites, from the moment passengers book their ticket they will be able to watch trailers, decide what to view and even provide direct feedback by voting for their favorite onboard movies. Passengers would also be able to buy an audio track they have listened to via referral links to sites such as Amazon or iTunes. IFP also develops customized mobile applications to bring entertainment even closer to passengers. For example, the “Movies&more” mobile application for airline customer KLM, created by IFP, was the first to provide full entertainment listings of films (with trailers), television shows and music available aboard KLM aircraft.

Software and Gaming

With over 100 airline customers and a catalog of over 180 game titles, we have the largest market share in international in-flight gaming content. Creative teams work to produce casual games customized to suit the in-flight environment. We also acquire multi-year licenses from reputable game publishers to adapt third party branded games and concepts for in-flight use from partners such as Disney, EA, Popcap, Tetris, Namco Bandai, DK and Berlitz. Our Content services include cultural expertise to adapt the software we deliver to the language and cultural specificities of each airline customer's passenger demographics. In addition, our Content business develops software applications for the next generation of in-flight entertainment systems, including interactive electronic menus and magazines.

Technology

Row 44 Connectivity Solution

Our proprietary connectivity system operated by our subsidiary, Row 44, optimizes performance, features and user experience for an in-flight entertainment system. A server, modem(s), wireless access points and related hardware are installed in the headliner of the interior cabin ceiling of an aircraft, while a satellite communications tracking antenna is mounted under a radome on the top of the aircraft’s fuselage. The key system components of the Row 44 platform are illustrated below:

For Wi-Fi connected services, the system works by enabling a passenger Wi-Fi accessible device connected to a Row 44 wireless access point, or WAP, and authorized to use the service to send typical TCP/IP based communications to the WAPs in the aircraft cabin. The WAPs feed data to a single or multiple satellite modems that then utilize the specialized satellite antenna to point at a satellite in the Row 44 network and transmit data to the satellite for relay to a ground earth station and then to the Internet. The responsive data from the Internet travels the same path in the opposite direction, ultimately returning to the passenger's device. To access content-on-demand and similar stored services, the Row 44 on-board server delivers the applicable content wirelessly from solid state storage devices within the server to the passenger's device. For accessing live television, the live television signals are delivered in a continuous stream of data from Row 44’s ground earth stations to each aircraft in the applicable coverage area. Passenger devices authorized to access the live television service do so through a connection to the same WAP used to deliver Wi-Fi connectivity. All of these services are monitored, maintained and controlled around the clock by Row 44’s dedicated network operations center in Lombard, Illinois and by an additional network operation center maintained by Hughes Network Systems (or third parties under contract with Hughes) pursuant to service agreements with Hughes.

Close relationships with key industry operators like Hughes Network Systems have allowed us to develop a very sophisticated and reliable satellite based system. Hughes is a global broadband satellite network services company and has been a supplier of satellite and network services to Row 44 since 2006. Hughes supplies Row 44 with satellite gateway and related network equipment and modem cards for use as part of the Row 44 system. Hughes also (i) operates several network operations centers for monitoring and servicing the broadband system on a 24/7 basis, (ii) arranges for and provides Row 44 a terrestrial “back haul” link from its network operations centers to the Internet and (iii) arranges for the provision of satellite connectivity service for communications from aircraft equipped with the Row 44 platform to and from the ground-based gateway. Row 44 is currently the exclusive recipient of Ku transmission services from Hughes within the field of broadband Internet connectivity to commercial aircraft in North America. Row 44’s relationship with Hughes affords Row 44 unparalleled access to a global leader in satellite networks and services. Hughes’ global reach within the satellite industry also gives Row 44 a competitive advantage, and Hughes’ turnkey network solutions and extensive network operations experience give Row 44 the power of a

major network provider at a fraction of the cost of building out such infrastructure. Hughes also has extensive satellite network design engineering and program management resources that Row 44 is able to leverage as needed.

Wireless In-flight Services and Entertainment Solution

Starting in 2014, we expect to offer customers our Wireless In-flight Services and Entertainment (WISE) software solution developed by our subsidiary DTI Solutions. WISE is one of the latest Wi-Fi-based content and services delivery platforms for the airline industry. WISE software allows airlines to deliver content to a wide-variety of passenger mobile devices through a Wi-Fi system that is native and embedded into the aircraft itself or via a variety of add-on systems. WISE is designed to work in a non-connected environment and also is compatible with in-flight connectivity systems. The WISE software platform includes industry standard digital rights management (DRM) compatible with latest available airline available content and payment processing functionality. To date we have partnered with Rockwell Collins, Airbus, Honeywell and OnAir for delivery of the WISE solution to airline customers.

Customers

We currently deploy our Connectivity services worldwide to the airline industry, with customers located in North America, South Africa and Europe, including Russia and Iceland. We are currently under trials to install our Connectivity solution in aircrafts operated by Air China in 2014. For fiscal year 2013, our largest Connectivity airline customer was Southwest Airlines, which represented approximately 22% of our total consolidated revenue in 2013.

We provide Content curating and processing services to the airline, maritime, and non-theatrical industries globally. Our customers also include major Hollywood and international studios. We are the exclusive representative to over 60 airlines for our Content services.

Competitive Advantages

We are developers, acquirers and distributors of satellite bandwidth entertainment, gaming and other media content and work closely with major and independent studios and other content producers. Accordingly, our significant operating and deal-making experience and relationships with companies in these industries gives us a number of competitive advantages and may present us with a substantial number of additional business targets and relationships to facilitate growth going forward. We believe that we have sustainable competitive advantages due to our market positions, technology and relationships with important content suppliers and airlines.

Connectivity

Our leading satellite-based broadband services allow us to connect airlines passengers to the Internet and deliver live streaming television, stored content on demand and other related services over land and sea. Unlike competitive technologies such as air-to-ground GSM or Ka-band satellite solutions, our Ku-band satellite Wi-Fi platform is capable of being operated from gate-to-gate and over the majority of the commonly used air routes across the globe at data throughput levels required to deliver a feature-rich in-flight entertainment experience. We also have an exclusive relationship with Hughes and have network operational footprints in North America, Europe and Russia. These competitive advantages provide us the ability to more rapidly on-board and service new and existing airline customers regardless of where they fly.

In addition to regional expansion, we have the ability to rapidly expand our product offerings worldwide. We recently launched our live television and our texting services in the United States and expect to offer similar and other related services in additional markets. We also have programs in place offering gate-to-gate connectivity services in markets where this service is permitted. Targeting heavily air-trafficked regions allows us to leverage existing customers and add additional airline customers with little interruption to our base operations. Adding customers in areas with existing satellite coverage (utilized for launch customers) allows us to spread fixed costs associated with transponders over a larger network base.

We have dedicated Connectivity engineering resources, which enable us to deploy end-to-end solutions for our airline customers. Our engineering resources are able to assist our airline customers in obtaining necessary regulatory approvals such as the STCs, which permit our equipment to be installed and operated on the applicable aircraft type covered by the STC (regardless of airline operator). As we continue to obtain STCs on a wider variety of plane types, we will be able to leverage these STCs for more rapid deployment on new airline customers in the future on a more cost-effective and efficient basis.

Content

We are the leader in providing content and services to airlines around the world and across all continents. Our cultural expertise allows us to provide customized solutions to accommodate cultural and linguistic requirements in all key markets, across all airlines. We provide our content services to the vast majority of airlines in markets such as the Middle East, Asia and Europe, where demand for content tends to be stronger and airlines are more widely equipped with on-board in-flight entertainment solutions. North American airlines have traditionally focused less on on-board in-flight entertainment solutions, but there are signs of reinvestment and a shift towards providing a wider variety of in-flight entertainment content on-board North American carriers in the coming years. More recently, we broadened our portfolio of content services by becoming a solution provider for advanced, interactive in-flight entertainment hardware systems. The new in-flight entertainment hardware systems provide the technological basis for turning the systems previously used only for the purpose of entertaining passengers into interactive passenger platforms that offer a variety of possibilities. In the in-flight entertainment industry, this strategic development entails changing in-flight entertainment into a total ‘‘passenger experience.’’ We intend to leverage our market position and technological know-how to participate in and take advantage of this cutting-edge development in in-flight entertainment.

With AIA, and the additions of PMG and IFES in the second half of 2013, we strengthened our position as a global leader in content services for the airline market. With the ability to offer the widest variety of content, games and related services, we provide our customers a wider variety of content options and more cost-effective content solutions to our customers.

Our Strategy

We believe that our combined Content and Connectivity offering is uniquely positioned to change the existing in-flight entertainment content model and drive towards a synergized entertainment and commerce platform. Using portals created specifically for the in-flight audience, we provide Internet access, content-on-demand, and live television programming. Providing this rich content direct to passengers’ own devices has created new opportunities for revenue from passengers on our customer airlines and from brand sponsorship.

Connectivity

We are seeking to aggressively to expand our connectivity solutions to customers worldwide, particularly outside of North America. We are strategically targeting markets with high populations and traffic density, having begun with North America and Europe, and more recently in Asia. Particularly in China, Southeast Asia and South America, we are seeking to gain early-entrant advantage with our satellite-based connectivity solutions.

Leverage Technology

We believe we have the most technologically advanced connectivity solution in the market today, and plan to continue to leverage this as we target expansion in new and emerging markets. The lack of a comparable connectivity solution in the market today creates a large opportunity for us, particularly with carriers who fly across international borders. With a proven connectivity solution in the US and Europe, we can continue to leverage our existing technology to expand our connectivity solutions globally, and capture market share in emerging markets such as Western Europe, China and the Middle East..

Continue Technological Evolution

We work continuously to improve existing systems and user interfaces, while also developing plans to remain at the forefront of the technology curve. We are in the process of evaluating additional technologies such as a Ka band satellite solution and utilization of high-throughput Ku-band satellites (HTS) to maintain our competitive advantage as the industry evolves. We also expect to continue to develop better-performing components of our system, including components to better service long-haul carriers. Our strategic decision to develop key components and systems that interface with handheld devices enable our airline customers to stay on the cutting edge without completely replacing or having to invest in on-board entertainment systems.

Content

Supply-Chain Efficiency

Through AIA, PMG and IFES and related subsidiaries, we have attained critical mass in the in-flight entertainment content market that will open up the possibilities of managing larger airline budgets, as well as providing a fully outsourced solution to our customers. We believe that this will lead to longer-term contracts and a wider variety of services. We have

already demonstrated this in early 2014 with new contracts awarded for more than five years and covering creative user interfaces and innovation as well as traditional content. The scale we now have in our post-production facilities and range in content rights management allows for a more efficient cost structure and to begin servicing newer, smaller and more remote airlines customers.

Increasing the Value of Traditional Content

We are the leading provider of IFE content and solutions to the airline industry. With a broad range of content solutions, we offer unparalleled services to our airline customers, as well as the ability to provide them with more cost-effective and outsourced solutions. Our ability to efficiently scale our post-production facilities and provide a range of content rights management to our customers is unmatched by our competitors. We believe that this will lead to expanded services with existing customers, and allow us to more rapidly expand our services to newer, smaller and more remote airlines customers.

Competition

Our Connectivity operating segment operates in a highly competitive environment. In addition to competition from other in-flight connectivity providers such as GoGo and OnAir, we also compete with other in-flight entertainment service providers such as Thales and Panasonic Avionics. Other connectivity service providers use different technology, including air-to-ground mobile services, L-band satellite connectivity and Ka-band satellite connectivity, to provide connectivity to airliners; however, Panasonic Avionics uses the same Ku-band connectivity services. We believe Ku-band satellite services offer the best combination of worldwide availability, available high-speed bandwidth and cost versus competing technologies. In addition, our connectivity solutions are focused on delivering the best passenger experience, and provide a significant value difference when compared to existing solutions offered by our competition.

Our Content operating segment operates in a highly fragmented market. As of December 31, 2013, our combined Content operations service the majority of the content market for the worldwide airline industry through our acquisitions of AIA, PMG and IFES. In addition to the overall fragmented market for our content and related services, we compete with other IFES leading providers including Spafax. We believe our state-of-the-art studio services offer unparalleled solutions to our airline and studio partners versus our competitors. In addition, our worldwide relationships with major airline carriers and Hollywood studios provide us a significant competitive advantage over our competition.

Government Regulation

As a participant in the global airline and global telecommunication industries we are subject to a variety of government regulatory obligations.

Federal Aviation Administration/European Aviation Safety Agency

Our Connectivity division’s primary product involves the installation of material hardware onboard commercial airliners. The installation of equipment on airliners is subject to the rules and regulations promulgated by the Federal Aviation Administration ("FAA") and its global counterparts, including the European Aviation Safety Agency ("EASA"). Prior to installing our equipment on an aircraft type, we are required to obtain a STC, which supplements the original Type Certificate obtained by the original aircraft manufacturer from the FAA/EASA and identifies the parts to be installed and the location of the installation and will only be issued by the FAA/EASA after we comply with any additional regulations for the installation of hardware such as ours (for example, bird strike regulation compliance). To date, we have obtained STCs for installing our connectivity solution hardware on the Boeing 737 Next Generation series of aircraft and the Boeing 757 aircraft type. We currently have additional STC projects underway and expect to obtain additional STCs throughout 2014.

Global AMSS Regulation

In order to operate our connectivity services, we are also required to obtain authorization in each jurisdiction over which we intend to provide our aero mobile satellite services (AMSS). In the USA, we obtained a license from the Federal Communications Commission (FCC) allowing us to provide AMSS services subject to compliance with various requirements imposed by the FCC. Certain other countries require affirmative licenses, however many countries require notification of intent to provide services and various technical details without the need for obtaining affirmative approval. To-date we are authorized to provide our AMSS connectivity services in over 150 countries.

Employees

As of December 31, 2013, we had 730 employees, 228 of whom are employed in the United States. None of our employees is represented by a labor union or is subject to a collective bargaining agreement. We believe that relations with our employees are good.

Segment Reporting and Geographic Information

For additional information regarding our segments, including information about our financial results by geography, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and Note 2. Basis of Presentation and Summary of Significant Accounting Policies to our consolidated financial statements included in Item 15. Exhibits and Financial Statement Schedules.

Corporate History

Prior to January 31, 2013, we were known as Global Eagle Acquisition Corp., a Delaware corporation that was formed in February 2011 to effect a merger, capital stock exchange, asset acquisition or similar business combination with one or more businesses. In May 2011, the Company consummated an initial public offering. On January 31, 2013, we completed a business combination transaction (the "Business Combination") in which we acquired all of the outstanding capital stock of Row 44 and 86% of the shares of AIA, and changed our name to Global Eagle Entertainment Inc. Prior to the consummation of the Business Combination, the Company did not engage in any business except for activities related to its formation and related public financing.

Subsequent to the Business Combination, we acquired an additional approximately 8% of the shares of AIA, such that as of December 31, 2013, we owned approximately 94% of the shares of AIA. The shares of AIA's capital stock not owned by us are listed in the Regulated Market ("General Standard") of the Frankfurt Stock Exchange. In July 2013, we commenced a process under German law to acquire the remaining 6% of the shares of AIA, which we expect to complete in the first half of 2014.

Additional information regarding the Business Combination is set forth in (i) our definitive proxy statement filed with the U.S. Securities and Exchange Commission (“SEC”) on January 17, 2013, (ii) our Annual Report on Form 10-K for the year ended December 31, 2012 filed with the SEC on March 18, 2013 and (iii) our Current Reports on Form 8-K and Forms 8-K/A filed with the SEC on February 6, 2013, March 18, 2013, May 16, 2013 and August 9, 2013.

Our principal executive offices are located at 4553 Glencoe Avenue, Los Angeles, California, 90292.

Available Information

Our main corporate website address is www.globaleagleent.com. Copies of the Company’s Quarterly Reports on Form 10-Q, Annual Report on Form 10-K and Current Reports on Form 8-K filed or furnished to the U.S. Securities and Exchange Commission (the “SEC”), and any amendments to the foregoing, will be provided without charge to any shareholder submitting a written request to the Secretary at the principal executive offices of the Company or by calling (818) 706-3111. All of the Company’s SEC filings are also available on the Company’s website at http://investors.globaleagleent.com/financials.cfm, as soon as reasonably practicable after having been electronically filed or furnished to the SEC. All SEC filings are also available at the SEC’s website at www.sec.gov.

We also webcast our earnings calls and certain events we participate in or host with members of the investment community on the investor relations section of our corporate website. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, and press and earnings releases on the investor relations section of our corporate website. Investors can receive notifications of new press releases and SEC filings by signing up for email alerts on our website. Further corporate governance information, including our board committee charters and code of ethics, is also available on our website at http://investors.globaleagleent.com/governance.cfm. The information included on our website, or any of the websites of entities that we are affiliated with, is not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our website are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

Investing in our common stock involves substantial risks. In addition to the other information included in this report, the following risk factors should be considered in evaluating our business and future prospects. The risk factors described below are not necessarily exhaustive, and you are encouraged to perform your own investigation with respect to us and our

business. You should also read the other information included in this report, including our financial statements and the related notes. As described more fully below, our business is subject to risks and uncertainties that fall in the following categories:

•Risks Related to Our Connectivity Operating Segment;

•Risks Related to Our Content Operating Segment;

•Risks Related to Our Technology and Intellectual Property and Government Regulation;

•Risks Related to Our Business and Industry; and

•Risks Related to Our Securities.

Risks Related to Our Connectivity Operating Segment

We rely on one key customer for a substantial percentage of our Connectivity operating segment’s revenue.

Our Connectivity operating segment, which we operate through our wholly-owned subsidiary, Row 44, is substantially dependent on its customer relationship with Southwest Airlines, which accounted for 73%, 85% and 62% of our Connectivity operating segment’s revenues for the years ended December 31, 2013, 2012 and 2011, respectively, and 22% of our consolidated revenue for the year ended December 31, 2013. Row 44 and Southwest are parties to an Amended and Restated Supply and Services Agreement, dated as of February 1, 2013, governing the supply by Row 44 of products and services to Southwest, including units of Row 44’s broadband system, Wi-Fi service in connection use such broadband system, live television related services and certain additional contemplated services. If Row 44 fails to meet certain service level requirements related to its television service to Southwest Airlines under the agreement, Southwest Airlines may terminate Row 44’s television service on Southwest aircraft. Similarly, if Row 44 fails to meet certain other obligations related to its technology, equipment and services, Southwest may have the right to terminate the entire agreement with Row 44. Our business would be materially adversely affected if Southwest terminates either the television service or the entire agreement with Row 44.

Our Connectivity operating segment has a limited operating history, which may make it difficult to evaluate our current business and predict our future performance.

Our Connectivity operating segment did not complete the first installation of its connectivity system until 2009 and did not begin to generate service revenue until 2010. The limited operating history of our Connectivity operating segment may make it difficult to accurately evaluate our potential growth and future performance. Any assessments of our Connectivity operating segment and predictions that we make about future success or viability may not be accurate. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries, and the size and nature of our market opportunity will change as we scale our business and increase deployment of our in-flight connectivity system.

We may face increased competition from next generation connectivity technologies.

Ka-band connectivity solutions are in the early stage of deployment on airlines and may offer benefits for certain of the types of services our Ku-band connectivity solution provides. If airlines value the services in which Ka-band provides those benefits, we may be forced to invest in improving our product offering, including possibly by investing more in our current solution or adopting a new technology, to maintain our current connectivity customers and attract additional customers. Other next generation connectivity solutions, including so-called “ground-to-orbit” solutions have been announced that may also require us to take similar action.

Our Connectivity operating segment has incurred significant operating losses since its inception.

Prior to the second half of 2013, our Connectivity operating segment had incurred significant operating losses since Row 44’s inception in 2004, and it may not be able to generate sufficient revenue in future periods to generate operating income or positive cash flow. We also expect the operating segment’s costs to fluctuate materially in future periods as we continue to invest resources and inventories in new customers and services, which could negatively affect our future operating results. We expect to continue to expend substantial financial and other resources as we continue to expand our Connectivity operating segment internationally. The amount and timing of these costs are subject to numerous variables. Such variables include the availability and timing of certain next-generation technologies, such as Ka-band and other satellite technologies, as well as costs incurred to develop and implement changes to airborne software and hardware, the need and costs to expand our service offerings to be competitive and, with respect to satellite technologies, the cost of obtaining satellite capacity.

We face limitations on our ability to grow our domestic Connectivity operations that could harm our operating results and financial condition.

Our ability to expand our Connectivity operating segment domestically at its current rate of growth is inherently limited by various factors, including the limited on the number of U.S. and foreign commercial airlines operating over our domestic coverage area and who have not already selected a connectivity partner or are otherwise available to sell our products and service, the number of planes operated by our current customers which have not yet been connected and in which our connectivity system can be installed and the passenger capacity within each plane. The growth of our Connectivity operating segment may slow when compared to more recent results, to the extent that we have exhausted all substantial potential airline customers, and as we approach installation on full fleets and maximum penetration rates on all flights. We cannot provide assurance that we will be able to profitably expand the domestic market presence or establish new markets and, if we fail to do so, our business and results of operations could be materially adversely affected.

We may be unsuccessful in generating revenue from live television, portal and content-on-demand services.

We are developing and are scheduled to deploy a number of service offerings to deliver to our commercial airline customers.

Live Television

We currently offer up to 18 channels of live television service in the United States, and we intend to expand our live television service to our airline customers in Europe, although there can be no assurance that we will be successful in doing so or in generating meaningful revenue from that source of content abroad. In the U.S., our customer Southwest Airlines maintains a sponsor for its “TV Flies Free” offering which will continue at least through the end of 2014, with a possible extension to 2015. The expiration or termination of this sponsorship, however, could have a material impact on our Connectivity operating segment’s revenue. Additionally, if we are unable to replicate the live television sponsorship model with other airlines, or the take rate for a passenger fee-based live television model does not meet expected targets, our Connectivity operating segment’s ability to generate revenue could be materially adversely affected.

Portal Services

We currently deploy several advertising based portal services such as a moving map with flight information and we recently launched a Wi-Fi Internet-based texting service onboard Southwest Airlines aircraft. We also intend to further develop and deploy additional Wi-Fi Internet portal services, which we believe will provide our Connectivity operating segment a substantial revenue opportunity in the near term. However, Wi-Fi portal services generate only nominal revenue today. We therefore cannot make any assurance that we will be successful in developing and deploying portal services or that our ability to generate revenue from these services will match our expectations. If our portal services are not successful, our growth and financial prospects would be materially adversely impacted.

Content-on-demand

Separate from content-on-demand offering as part of our live television services, we are also working to increase the number of on-demand movies and other content available on our Wi-Fi Internet connectivity system. The future growth prospects for our business depend, in part, on revenue from advertising fees and e-commerce revenue share arrangements on passenger purchases of goods and services, including video and media services. Our ability to generate revenue from these service offerings depends on:

•growth of our Connectivity operating segment’s commercial airline customer base;

•the attractiveness of our Connectivity operating segment’s customer base to media partners;

| |

• | rolling out live television and content on demand on more aircraft and with additional airline customers and increasing passenger adoption both in the U.S. and abroad; |

| |

• | establishing and maintaining beneficial contractual relationships with media partners whose content, products and services are attractive to airline passengers; and, |

| |

• | our ability to customize and improve our Connectivity operating segment’s service offerings in response to trends and customer interests. |

If we are unsuccessful in generating revenue from our Connectivity operating segment’s service offerings, that failure could have a material adverse effect on our growth prospects, financial condition and results of operation.

We may be unsuccessful in expanding our Connectivity operating segment internationally, which could harm the growth of our business, operating results and financial conditions.

The ability to further expand our Connectivity operating segment internationally involves various risks, including the need to invest significant resources in unfamiliar markets and the possibility that there may not be returns on these investments in the near future, comparable to our recent financial results or at all. In addition, our Connectivity operating segment has incurred, and we expect to continue to incur, expenses before we generate any material revenue in these new markets. Our Connectivity operating segment’s ability to expand will also be limited by the demand for in-flight broadband Internet access in key international markets. Different privacy, censorship, aerospace and liability standards and regulations, governmental instability and political change and different intellectual property laws and enforcement practices in foreign countries may cause our business and operating results to suffer. Additionally, any failure to compete successfully in international markets could negatively impact our reputation and domestic operations.

Any future international operations may fail to succeed due to risks inherent in foreign operations, including:

•different technological solutions for broadband Internet than those used in North America;

•varied, unfamiliar and unclear legal and regulatory restrictions;

•unexpected changes in international regulatory requirements and tariffs;

•unexpected changes in governmental or political structures in certain foreign countries;

| |

• | legal, political or systemic restrictions on the ability of U.S. companies to do business in foreign countries, including restrictions on foreign ownership of telecommunications providers or the establishment of economic sanctions by the U.S. affecting businesses such as ours; |

•inability to find content or service providers to partner with on commercially reasonable terms, or at all;

•Foreign Corrupt Practices Act compliance and related risks;

•difficulties in staffing and managing foreign operations;

•currency fluctuations; and

•potential adverse tax consequences.

As a result of these obstacles, we may find it difficult or prohibitively expensive to grow our Connectivity operating segment internationally or may be unsuccessful in our attempt to do so, which could harm our future operating results and financial condition.

We are currently engaged in a trial of our Connectivity solution on an aircraft operated by Air China in connection with Air China's choice of a connectivity provider. Failure to win Air China as a client could have an adverse impact on our plans to expand our services into China.

We are currently under trial to install our Connectivity solution on an aircraft operated by Air China. The trial will commence aboard a 777-200 aircraft and will enable Air China’s passengers to access the Internet and stored content on approved handheld devices, in accordance with applicable Chinese regulations. An expansion of our business into China will require us to comply with a number of foreign laws, rules and regulations with which we have limited prior experience. Our management team’s lack of experience with these new requirements could increase the likelihood that we will inadvertently violate such a requirement, which could divert more of our resources and negatively impact our business. In addition, we

cannot assure you that the trials with Air China will be successful, which could mean that the costs incurred and resources expended in connection with these trials may not yield the expansion of our business that we have anticipated. Even if the trials with Air China are successful, we may not realize the benefits of the trial if we are unable to expand our business in China beyond one test aircraft. We cannot assure you that this expansion will generate additional revenues or increase our profitability. Even if this expansion generates the benefits that we have anticipated, there may be other unforeseeable and unintended factors or consequences that occur as a result of the expansion, which could adversely impact our profitability and our business.

We rely on single service providers for certain critical components of and services relating to our satellite connectivity network.

We currently source key components of our hardware, including the satellite antenna sourced from TECOM Industries, Inc., or TECOM, and key aspects of our connectivity services, including substantially all of our Connectivity operating segment’s satellite transponder services from partners of Hughes Network Systems, LLC, or HNS, from sole providers of equipment and network services, respectively. While we have contracts in effect with these key component and service providers, if we experience a disruption in the delivery of products and services from either of these providers, it may be difficult for us to continue providing our own products and services to our customers. We have experienced component delivery issues in the past, and there can be no assurance that we will avoid similar issues in the future. Additionally, any loss of exclusivity that we have with our hardware providers today could eliminate our competitive advantage in the use of satellites for in-flight connectivity in the future, which could have a material adverse effect on our business and operations.

We depend upon third parties to manufacture our Connectivity operating segment’s equipment components and to provide services for our network.

We rely on third-party suppliers for equipment components that we use to provide our satellite telecommunication Wi-Fi services. The supply of third party components could be interrupted or halted by a termination of these relationships, a failure of quality control or other operational problems at such suppliers or a significant decline in their financial condition. If we are not able to continue to engage suppliers with the capabilities or capacities required by our Connectivity operating segment, or if such suppliers fail to deliver quality products, parts, equipment and services on a timely basis consistent with our schedule, our business prospects, financial condition and results of operations could be adversely affected.

Risks Related to Our Content Operating Segment

The portion of our Content operating segment that is based on applications as part of in-flight entertainment has a limited operating history, which may make it difficult to evaluate our current business and predict our future performance.

AIA has developed applications to be used on more sophisticated in-flight entertainment hardware platforms as well as wireless streaming solution to be used on planes without in-flight entertainment hardware. Our application and wireless streaming businesses are still in a ramp up phase and have limited operating history. This makes it difficult for us to accurately evaluate the potential growth and future performance of the application and wireless streaming businesses. Any assessments of our application and wireless streaming services and predictions that we make about future success or viability may not be accurate. We have encountered and will continue to encounter risks and difficulties frequently experienced by companies expanding in new business areas in rapidly changing industries, and the size and nature of our market opportunity will change as we scale our application and wireless streaming businesses.

The future financial performance of our Content operating segment may be dependent on our ability to continue to acquire new companies that positively affect our financial performance.

Our Content operating segment’s growth both in revenues and profits in the past has been dependent on the ability to execute acquisitions of companies inside or outside of its core industry. There can be no assurance that we will be able to continue to make additional acquisitions in the future, or that any future acquisitions will have a positive impact on our financial performance. If we are unable to make such acquisitions or if they are not successful from a financial performance perspective, this could have a negative impact on our financial condition or results of operations.

We may not accurately predict the profit margins of our Content operating segment with respect to its long term fixed price contracts.

In some cases our Content operating segment has entered into multi-year, fixed-price delivery contracts with producers. These procurement contracts enable us to purchase content that a given studio releases or markets during the term of the contract at a fixed purchase price, or through “flat deals”. Adjustments of the previously agreed upon purchase price might be necessary in certain circumstances if there are significant changes in the customer base of our Content operating segment during the term of a given contract. If we are unable to make such adjustments upon the occurrence of such changes, there is a risk that the profit margins on our flat fee agreements may be smaller than predicted or even a loss, which could negatively impact our financial condition and results of operations.

AIA is subject to ongoing tax audits that could result in additional tax payments or a reduction in tax loss carryforwards.

A comprehensive tax audit by the Canadian tax authorities of AIA’s Canadian subsidiary DTI Software for the tax years 2008, 2009, 2010, 2011 and 2012 is underway. More specifically, the Canadian tax authorities are currently investigating DTI’s tax status in Dubai, United Arab Emirates, and whether income derived in Dubai should have been constituted taxable earnings subject to Canadian income tax for the tax year ended December 31, 2008. We estimate the maximum Canadian income tax exposure for the taxable year 2008 is approximately $1.4 million, which includes approximately $0.6 million of potential interest and penalties. We are currently investigating these claims and are not able to estimate the aggregate potential tax liability that could result for subsequent tax years after 2008. If the Canadian tax authorities attempt to assess similar penalties for tax years subsequent to 2008, we may be subject to pay significant historical tax obligations, including penalties and accrued interest. In addition, DTI claims certain tax credit in the course of the development of games and applications in Canada including tax credits that support multimedia, e-commerce and research and development in Canada. It is possible that Canadian tax authorities might come to a different conclusion concerning the respective amount that DTI is able to claim. This could lead to an adjustment of the booked tax credits that could be material to our financial condition.

AIA currently make claims for investment tax credits that are available in Canada to support multimedia, e-commerce and research and development in Canada, and any reduction in or elimination of government support for such tax credits would negatively impact our business and results of operations.

DTI Software makes claims for currently available tax credits in Canada in the course of its development of games and applications in Canada, including tax credits that support multimedia, e-commerce and research and development in Canada. If governmental authorities in Canada, and, in particular, in the province of Quebec, were to reduce or eliminate the amount of tax credits that are available in respect of these activities by DTI, then our tax liabilities would likely increase, and this would have a negative impact on our overall profitability.

On-board use of personal electronic devices may harm our Content operating segment.

Ever-increasing numbers of passengers have their own personal electronic devices which they might use to bring their own content such as movies, music or games with them on a flight or to access on-board connectivity to the Internet, live television or content on demand. This could decrease demand for our Content operating segment’s in-flight offerings provided through seatback screens or other fixed on-board screens, which could have a material adverse effect on our financial condition and results of operation.

Many of our Content operating segment’s products will have long sales cycles, which may cause us to expend resources without an acceptable financial return and which makes it difficult to plan our expenses and forecast our revenues. This could have a material adverse effect on our business.

Many of our Content operating segment’s products have long sales cycles that involve numerous steps, including initial customer contacts, specification writing, software engineering design, software prototyping, pilot testing, device certification, regulatory approvals (if needed), sales and marketing and commercial manufacture, integration and delivery. During this time, we may expend substantial financial resources and management time and effort without any assurance that product sales will result. The anticipated long sales cycle for some of our Content operating segment’s products makes it difficult to predict the quarter in which sales may occur. Delays in sales may cause us to expend resources without an acceptable financial return and make it difficult to plan expenses and forecast revenues, which could have a material adverse effect on our business.

Our Content operating segment may not retain or attract customers if we do not develop new products and enhance our current products in response to technological changes and competing products , or if our new or enhanced products do not gain market acceptance.

The in-flight entertainment market is faced with rapid technological change, evolving standards in computer hardware, software development, communications and security infrastructure, and changing needs and expectations of customers. Building new products and service offerings requires significant investment in development. A substantial portion of our Content operating segment’s research and development resources are devoted to maintenance requirements and product upgrades that address new technology support. These demands put significant constraints on the resources that we have available for new product development. We also face uncertainty when we develop or acquire new products for our Content operating segment, because there is no assurance that a sufficient market will develop for those products.

We are exposed to foreign currency risks, and our lack of a formal hedging strategy could create losses.

Within our Content operating segment, currency risks arise from the fact that both sales to customers and purchasing are largely effected in U.S. dollars, while most of our Content operating segment’s operating companies’ fixed costs are incurred in euros, British pounds and Canadian dollars. At times, we may engage in hedging transactions to counteract direct currency risks. However, we do not have a formal hedging strategy, and cannot always guarantee that all currency risks have been hedged in full. Severe currency fluctuations could also cause the hedging transactions to fail if agreed thresholds (triggers) are not met or exceeded. We therefore cannot fully preclude negative foreign currency effects in the future-some of which might be substantial-due to unforeseen exchange rate fluctuations and/or inaccurate assessments of market developments.

There are also intragroup receivables and liabilities in our Content operating segment, such as loans that can generate significant foreign currency effects. Changes in the exchange rates of a number of foreign currencies against the euro, especially the U.S. dollar and the Canadian dollar, could lead to the recognition of unrealized foreign exchange losses in some cases, particularly as a result of intragroup transactions. Therefore, our Content operating segment is exposed to a heightened currency risk in connection with intragroup borrowing owing to the foreign currency sensitivity in severe and unforeseeable exchange rate movements that are consequently difficult to predict.

Our Content operating segment faces intense pricing pressure.

Pricing pressures are high in the content market. As a result, we may need to provide significant price concessions in connection with the frequent tenders in which we engage in order to acquire new customers or keep current customers. . This may have a negative adverse effect on our revenue and results of operations.

We source our content from studios, distributors and other content providers, and any reduction in the volume of content produced by such content providers could hurt our Content operating segment by providing it with less quality content to choose from and resulting in potentially less attractive offerings for passengers.

We receive content from studios, distributors and other content providers, and, in some circumstances, we depend on the volume and quality of the content that these content providers produce. If studios, distributors or other content providers were to reduce the volume or quality of content that they make available to us over any given time period, whether because of their own financial limitations or other factors influencing their businesses, we would have less quality content to choose from, and our programmers would have more difficulty finding relevant and appropriate content to provide to our customers. This could negatively impact the passenger experience, which could, in turn, reduce the demand for our Content operating segment’s offerings, which would have a negative impact on our revenue and results of operations.

Our revenue may be adversely affected by a reduction or elimination of the time between our receipt of content and the content being made more broadly publicly available to the rental or home viewing market.

We receive the content that we provide through our Content operating segment directly from studios, distributors and other content providers, and the timing is at the discretion of the content providers. Historically, we and (prior to the Business Combination) AIA received content prior to such content being more broadly publicly distributed via rental viewing, retail stores or Internet streaming services. If a content provider delays release of certain content in a manner reducing or eliminating this “early window”, our Content operating segment may not be able to generate as much revenue from such content as we could have generated with an earlier release date.

The revenue generated by our Content operating segment may be adversely affected by a reduction or elimination of use of our Content operating segment’s services by competitors in the marketplace.

A portion of our income is currently generated by the licensing of software and content and by the performance of content processing services for direct competitors, including other content service providers, of our Content operating segment.

If our competitors develop their own software and content acquisition and processing capabilities, our Content operating segment may be materially adversely affected.

Risks Related to our Technology, Intellectual Property and Government Regulation

Our Connectivity operating segment may suffer service interruptions or delays, technology failures or damage to its equipment.

Our reputation and ability to attract, retain and serve our commercial airline customers depends, in part, upon the reliable performance of our Connectivity operating segment’s satellite transponder capacity, network infrastructure and connectivity system. The operations and services of our Connectivity operating segment depend upon the extent to which our equipment and the equipment of our third-party network providers is protected against damage from fire, flood, earthquakes, power loss, solar flares, telecommunication failures, computer viruses, break-ins, acts of war or terrorism and similar events. Damage to our networks could cause interruptions in the services that we provide through our Connectivity operating segment, which could have a material adverse effect on our service revenue, our reputation and our ability to attract or retain customers. Row 44 has experienced interruptions in these systems in the past, including component and service failures that temporarily disrupted users’ access to the Internet, and we may experience further service interruptions, service delays or technology or systems failures, which may be due to factors beyond our control. If we experience frequent system or network failures, our reputation could be harmed and our airline customers may have the right to terminate their contracts with us or pursue other remedies, which could have a material adverse effect on our financial condition and our ability to attract and retain customers.

Assertions by third parties of infringement, misappropriation or other violations by us of their intellectual property rights could result in significant costs and substantially harm our business and operating results.

In recent years, there has been significant litigation involving intellectual property rights in many technology-based industries, including the wireless communications industry. Any infringement, misappropriation or related claims, whether or not meritorious, are time-consuming, divert technical and management personnel and are costly to resolve. As a result of any such dispute, we may have to develop non-infringing technology, pay damages, enter into royalty or licensing agreements, cease providing certain products or services or take other actions to resolve the claims. These actions, if required, may be costly or unavailable on terms acceptable to us. Certain of our suppliers do not provide indemnity to us for the use of the products and services that these providers supply to us. At the same time, we generally offer third party intellectual property infringement indemnity to the customers of our Connectivity operating segment which, in some cases, do not cap our indemnity obligations and thus could render us liable for both defense costs and any judgments. Any of these events could result in increases in our operating expenses, limit our service offerings or result in a loss of business if we are unable to meet our indemnification obligations and our airline customers terminate or fail to renew their contracts.

On December 28, 2012, Advanced Media Networks, L.L.C. filed suit in the United States District Court for the Central District of California against Row 44 and one of its customers, which Row 44 has agreed to indemnify for allegedly infringing two of its patents and seeking injunctive relief and unspecified monetary damages. After Row 44 requested reexamination of the patents by the U.S. Patent & Trademark Office, the lawsuit was stayed. The lawsuit remains stayed, and the reexaminations have not concluded. Based on currently available information, the Company believes it has strong defenses. If the patents survive reexamination, the Company intends to defend vigorously against this lawsuit, though the outcome of this matter is inherently uncertain and could have a materially adverse effect on its Connectivity business, financial condition and results of operations. The potential range of loss related to this matter cannot be determined and as a result, no reserve has been established.

We are subject to civil litigation involving allegations of copyright infringement, which could result in our having to pay damages. We may also be subject to additional similar litigation in the future.